Expanding Climate Insurance Gap: Impact on Marginalized Canadians

Evidence from Canada, the United States, and Europe highlights a troubling reality: weather-related disasters do not affect all populations equally. Those who suffer the most are often the ones with the least resources to cope with the aftermath.

Lower-income and marginalized communities face heightened exposure to these disasters, possess fewer resources for preparation and recovery, and bear a larger share of losses that insurance does not cover.

Even when insured, many individuals struggle to meet deductibles due to a lack of emergency savings. This often results in unaddressed damage, leaving people in unsafe or unhealthy living conditions and increasing their vulnerability to future disasters.

Insurance plays a crucial role in helping households recover and preventing them from descending further into poverty after a disaster. However, across Canada, insurance costs are rising and becoming harder to obtain. Between 2019 and 2023, average home insurance premiums increased by 21%, with a staggering 40% rise for lower-income Canadians.

Widening Protection Gap

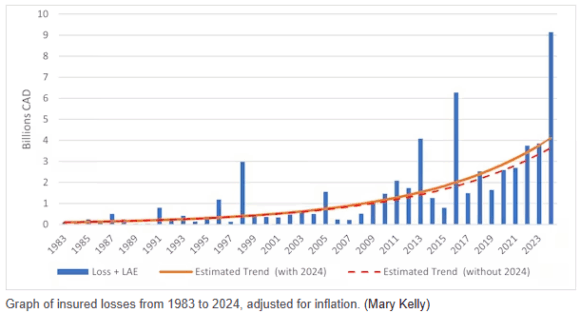

The growing insurance protection gap in Canada is alarming, especially as weather-related disasters are becoming more frequent and severe. Households without insurance face significant financial strain, making it difficult to meet basic needs. As extreme weather events escalate, the risk of families being unable to recover increases.

Affordability is a primary factor contributing to the protection gap, but other factors exist as well. Many Canadians lack a clear understanding of insurance benefits or underestimate the likelihood and costs associated with potential losses.

Accessibility remains a challenge, particularly in remote areas where insurance is typically purchased in person. While digital purchasing channels are on the rise, they do not address the needs of those without reliable internet or adequate digital skills.

Moreover, the insurance market often fails to cater to low-income or marginalized groups, resulting in a lack of suitable insurance products for these populations.

Strengthening Community Resilience

Enhancing insurance options, investing in mitigation, and providing better consumer support can help bridge these inequities and bolster resilience. Community-level mitigation strategies, such as land-use planning that avoids high-risk areas, can significantly reduce future losses. Initiatives like FireSmart aim to minimize wildfire damage, while infrastructure improvements can help adapt to a changing climate.

National assessments indicate that enhancing housing resilience can lower risks for lower-income and marginalized households, who often reside in older, poorly maintained homes. While major retrofits can be expensive, even minor upgrades—like improving drainage or using fire-resistant materials—can mitigate damage. Many municipalities offer targeted subsidies and incentive programs to support these improvements, especially for financially constrained households.

Making hazard information more accessible and comprehensible is essential to ensure that no one is left behind during disasters. Many Canadians lack clear information about the hazards they face and how to prepare for them. Certain groups, including newcomers and seniors, may encounter barriers in accessing or acting on available information.

Community support systems can further enhance resilience. Individuals with strong social connections and access to community organizations recover more quickly after disasters. Programs that foster local networks and support neighborhood groups can be implemented at a relatively low cost.

Closing the Protection Gap

A vital step in mitigating the unequal impacts of weather-related hazards is addressing Canada’s insurance protection gap. Microinsurance offers a promising solution, providing simplified, low-cost policies that deliver basic protection for households unable to afford traditional coverage.

Embedded tenant insurance—automatically included when renters sign a lease—is another approach to ensure basic coverage. Additionally, digital tools, such as mobile-friendly sign-up platforms and straightforward policy explanations, can help reduce barriers for those struggling with technology.

Public support for income-tested premium subsidies or credits can make essential coverage more accessible for low-income households. Furthermore, community-based catastrophe insurance, where local governments or community groups arrange coverage for residents, presents another viable option.

While Canadians cannot halt extreme weather, collective efforts can prevent it from exacerbating inequality. Raising awareness, minimizing losses, closing insurance gaps, and building resilience are crucial steps in safeguarding those most at risk.

Photograph: A worker walks in a devastated neighborhood in west Jasper, Alberta, Monday, Aug. 19, 2024, after a wildfire caused evacuations and widespread damage in the National Park and Jasper townsite. (Amber Bracken/The Canadian Press via AP)

This article is republished from The Conversation under a Creative Commons license. The Conversation is an independent and nonprofit source of news, analysis, and commentary from academic experts. The original article can be accessed here.

Evidence from Canada, the United States, and Europe highlights a troubling reality: weather-related disasters do not affect all populations equally. Those who suffer the most are often the ones with the least resources to cope with the aftermath.

Lower-income and marginalized communities face heightened exposure to these disasters, possess fewer resources for preparation and recovery, and bear a larger share of losses that insurance does not cover.

Even when insured, many individuals struggle to meet deductibles due to a lack of emergency savings. This often results in unaddressed damage, leaving people in unsafe or unhealthy living conditions and increasing their vulnerability to future disasters.

Insurance plays a crucial role in helping households recover and preventing them from descending further into poverty after a disaster. However, across Canada, insurance costs are rising and becoming harder to obtain. Between 2019 and 2023, average home insurance premiums increased by 21%, with a staggering 40% rise for lower-income Canadians.

Widening Protection Gap

The growing insurance protection gap in Canada is alarming, especially as weather-related disasters are becoming more frequent and severe. Households without insurance face significant financial strain, making it difficult to meet basic needs. As extreme weather events escalate, the risk of families being unable to recover increases.

Affordability is a primary factor contributing to the protection gap, but other factors exist as well. Many Canadians lack a clear understanding of insurance benefits or underestimate the likelihood and costs associated with potential losses.

Accessibility remains a challenge, particularly in remote areas where insurance is typically purchased in person. While digital purchasing channels are on the rise, they do not address the needs of those without reliable internet or adequate digital skills.

Moreover, the insurance market often fails to cater to low-income or marginalized groups, resulting in a lack of suitable insurance products for these populations.

Strengthening Community Resilience

Enhancing insurance options, investing in mitigation, and providing better consumer support can help bridge these inequities and bolster resilience. Community-level mitigation strategies, such as land-use planning that avoids high-risk areas, can significantly reduce future losses. Initiatives like FireSmart aim to minimize wildfire damage, while infrastructure improvements can help adapt to a changing climate.

National assessments indicate that enhancing housing resilience can lower risks for lower-income and marginalized households, who often reside in older, poorly maintained homes. While major retrofits can be expensive, even minor upgrades—like improving drainage or using fire-resistant materials—can mitigate damage. Many municipalities offer targeted subsidies and incentive programs to support these improvements, especially for financially constrained households.

Making hazard information more accessible and comprehensible is essential to ensure that no one is left behind during disasters. Many Canadians lack clear information about the hazards they face and how to prepare for them. Certain groups, including newcomers and seniors, may encounter barriers in accessing or acting on available information.

Community support systems can further enhance resilience. Individuals with strong social connections and access to community organizations recover more quickly after disasters. Programs that foster local networks and support neighborhood groups can be implemented at a relatively low cost.

Closing the Protection Gap

A vital step in mitigating the unequal impacts of weather-related hazards is addressing Canada’s insurance protection gap. Microinsurance offers a promising solution, providing simplified, low-cost policies that deliver basic protection for households unable to afford traditional coverage.

Embedded tenant insurance—automatically included when renters sign a lease—is another approach to ensure basic coverage. Additionally, digital tools, such as mobile-friendly sign-up platforms and straightforward policy explanations, can help reduce barriers for those struggling with technology.

Public support for income-tested premium subsidies or credits can make essential coverage more accessible for low-income households. Furthermore, community-based catastrophe insurance, where local governments or community groups arrange coverage for residents, presents another viable option.

While Canadians cannot halt extreme weather, collective efforts can prevent it from exacerbating inequality. Raising awareness, minimizing losses, closing insurance gaps, and building resilience are crucial steps in safeguarding those most at risk.

Photograph: A worker walks in a devastated neighborhood in west Jasper, Alberta, Monday, Aug. 19, 2024, after a wildfire caused evacuations and widespread damage in the National Park and Jasper townsite. (Amber Bracken/The Canadian Press via AP)

This article is republished from The Conversation under a Creative Commons license. The Conversation is an independent and nonprofit source of news, analysis, and commentary from academic experts. The original article can be accessed here.