Scott Bessent Anticipates Massive Refund Checks from Trump’s Tax Cuts

White House National Economic Council Director Kevin Hassett joins ‘Varney & Co.’ to discuss the November CPI report, tax refunds, an anticipated White House announcement on housing reform and more.

Treasury Secretary Scott Bessent has made a bold prediction for the upcoming tax filing season, suggesting that Americans can expect “gigantic” refund checks. This forecast is attributed to the tax cuts included in President Donald Trump’s One Big Beautiful Bill Act (OBBBA).

During his appearance on the “All-In Podcast,” Bessent, who also serves as the acting commissioner of the IRS, explained that the tax provisions in the OBBBA, signed into law in July, are retroactive to the beginning of the year. As many workers did not adjust their withholdings, they can anticipate receiving substantial refunds in 2026.

FIVE MAJOR POLICIES TO KNOW FROM THE ONE BIG BEAUTIFUL BILL ACT

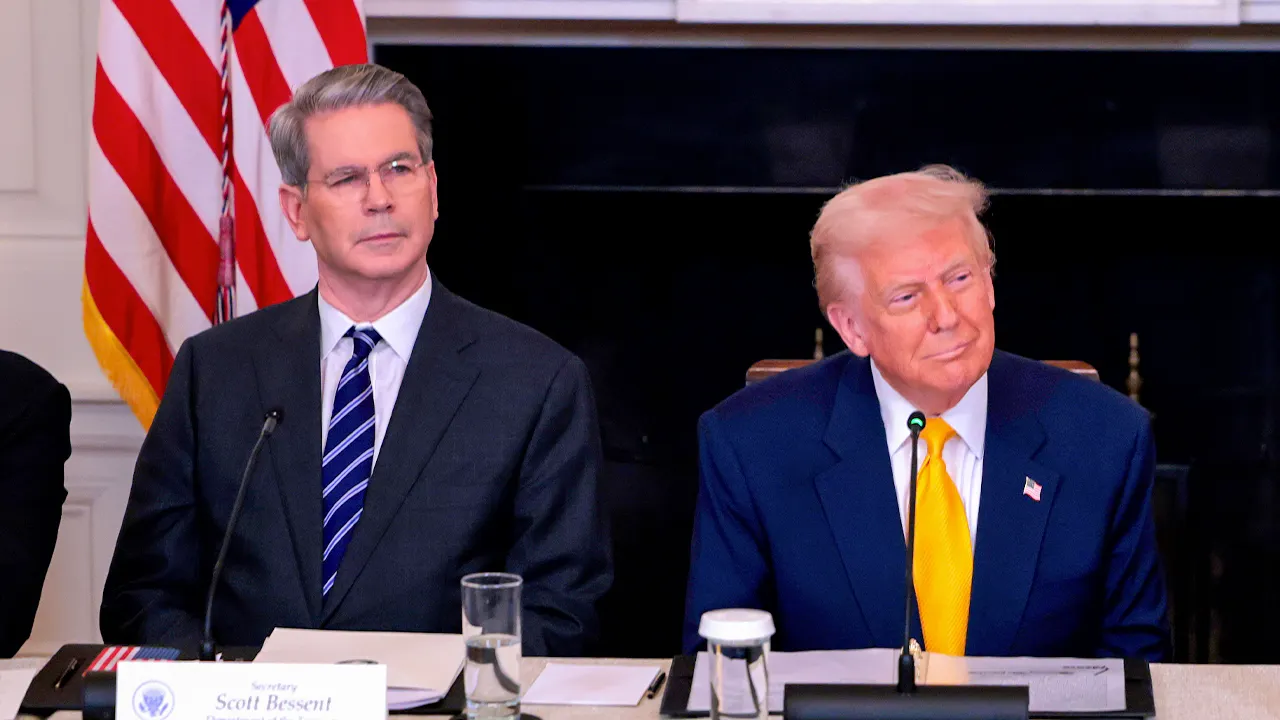

President Donald Trump speaks alongside Treasury Secretary Scott Bessent at The White House Digital Assets Summit at the White House on March 7, 2025, in Washington, D.C. (Anna Moneymaker/Getty Images / Getty Images)

“I can see that we’re gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings,” Bessent stated. “I think households could see, depending on the number of workers, $1,000- $2,000 refunds.”

Bessent’s forecast aligns with insights from the Tax Foundation, a nonpartisan tax policy organization. Their December 17 report indicated that “refunds will be larger than typical in the upcoming filing season because of the One Big Beautiful Bill Act’s (OBBBA) tax cuts for 2025.”

President Donald Trump signs the sweeping spending and tax legislation, known as the “One Big Beautiful Bill Act,” at the White House in Washington, D.C., on July 4, 2025. (Ken Cedeno/Reuters / Reuters)

IRS REVEALS 2026 TAX ADJUSTMENTS WITH CHANGES FROM ‘BIG, BEAUTIFUL BILL’

The Tax Foundation estimates that the OBBBA has reduced individual taxes by $144 billion for 2025. They also noted that up to $100 billion of this reduction could translate into higher tax refunds for Americans. While not every taxpayer will see a significant increase in their refunds, the foundation suggests that the average refund could rise by up to $1,000.

“However, since the IRS did not adjust withholding tables after the law was enacted, workers generally continued to withhold more taxes from their paychecks than the new law required. Consequently, instead of gradually benefiting from the tax cuts through increased take-home pay throughout the year, most taxpayers will receive their benefits all at once when they file their returns,” the Tax Foundation explained.

The Trump administration is expecting the largest tax refund cycle “in history” this spring 2026. (Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Tax Foundation has identified seven significant tax cuts enacted under the OBBBA that could lead to increased refunds. These include enhancements to the child tax credit, an elevated standard deduction, a higher SALT deduction cap, and new or expanded deductions for seniors, auto loan interest, tip income, and overtime pay.

White House National Economic Council Director Kevin Hassett joins ‘Varney & Co.’ to discuss the November CPI report, tax refunds, an anticipated White House announcement on housing reform and more.

Treasury Secretary Scott Bessent has made a bold prediction for the upcoming tax filing season, suggesting that Americans can expect “gigantic” refund checks. This forecast is attributed to the tax cuts included in President Donald Trump’s One Big Beautiful Bill Act (OBBBA).

During his appearance on the “All-In Podcast,” Bessent, who also serves as the acting commissioner of the IRS, explained that the tax provisions in the OBBBA, signed into law in July, are retroactive to the beginning of the year. As many workers did not adjust their withholdings, they can anticipate receiving substantial refunds in 2026.

FIVE MAJOR POLICIES TO KNOW FROM THE ONE BIG BEAUTIFUL BILL ACT

President Donald Trump speaks alongside Treasury Secretary Scott Bessent at The White House Digital Assets Summit at the White House on March 7, 2025, in Washington, D.C. (Anna Moneymaker/Getty Images / Getty Images)

“I can see that we’re gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings,” Bessent stated. “I think households could see, depending on the number of workers, $1,000- $2,000 refunds.”

Bessent’s forecast aligns with insights from the Tax Foundation, a nonpartisan tax policy organization. Their December 17 report indicated that “refunds will be larger than typical in the upcoming filing season because of the One Big Beautiful Bill Act’s (OBBBA) tax cuts for 2025.”

President Donald Trump signs the sweeping spending and tax legislation, known as the “One Big Beautiful Bill Act,” at the White House in Washington, D.C., on July 4, 2025. (Ken Cedeno/Reuters / Reuters)

IRS REVEALS 2026 TAX ADJUSTMENTS WITH CHANGES FROM ‘BIG, BEAUTIFUL BILL’

The Tax Foundation estimates that the OBBBA has reduced individual taxes by $144 billion for 2025. They also noted that up to $100 billion of this reduction could translate into higher tax refunds for Americans. While not every taxpayer will see a significant increase in their refunds, the foundation suggests that the average refund could rise by up to $1,000.

“However, since the IRS did not adjust withholding tables after the law was enacted, workers generally continued to withhold more taxes from their paychecks than the new law required. Consequently, instead of gradually benefiting from the tax cuts through increased take-home pay throughout the year, most taxpayers will receive their benefits all at once when they file their returns,” the Tax Foundation explained.

The Trump administration is expecting the largest tax refund cycle “in history” this spring 2026. (Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Tax Foundation has identified seven significant tax cuts enacted under the OBBBA that could lead to increased refunds. These include enhancements to the child tax credit, an elevated standard deduction, a higher SALT deduction cap, and new or expanded deductions for seniors, auto loan interest, tip income, and overtime pay.