Sompo Expands International Credit Investment Strategy

Sompo Holdings Inc. is strategically shifting its focus towards higher-yielding overseas credit investments to enhance profitability, as traditional business avenues face challenges. This move comes as Japan’s third-largest property and casualty insurer grapples with stagnation in its domestic market.

Based in Tokyo, Sompo has recently transitioned several investment managers from its Japan insurance subsidiary to the United States. According to Toshinobu Kondo, the general manager of Sompo’s investment management department, this strategy aims to streamline operations. By selecting the same asset managers for both Japanese and American deals, including private credit and junk bonds, the company hopes to reduce costs.

“We intend to invest broadly in credit assets that offer high profitability and diverse risk-return characteristics,” Kondo stated in an interview. He emphasized that asset management is becoming increasingly vital as a profit source for the insurer, although he refrained from disclosing specific investment targets.

Japanese property and casualty insurers like Sompo are facing difficulties in achieving robust growth within a mature home market. The rapidly aging population is diminishing demand for core products such as auto and home insurance, prompting companies to seek expansion opportunities abroad. Early indicators suggest some success in this direction.

For example, Sompo reported a total operating revenue increase of 4.7% for the fiscal year ending March 2025, largely driven by an 8.6% rise in overseas revenue. In contrast, domestic revenue growth was limited to just 1.9%, with figures remaining nearly flat for the past five years, according to Bloomberg data.

Additionally, a push from policymakers to dismantle cross-shareholdings—often blamed for fostering overly cozy corporate relationships that stifle competition—could provide a temporary boost to insurers. The divestment of these shares has yielded one-off trading profits, although it may reduce future dividend income.

“Further sales of strategic stock holdings and strong underwriting results are the primary profit drivers,” noted Steven Lam, a senior industry analyst at Bloomberg Intelligence, in a recent report.

Natural Disasters

However, insurers pursuing profits through underwriting face significant risks. The increasing frequency of natural disasters poses a challenge, while rising repair costs threaten the auto insurance sector, especially amid the highest inflation rates Japan has seen in decades.

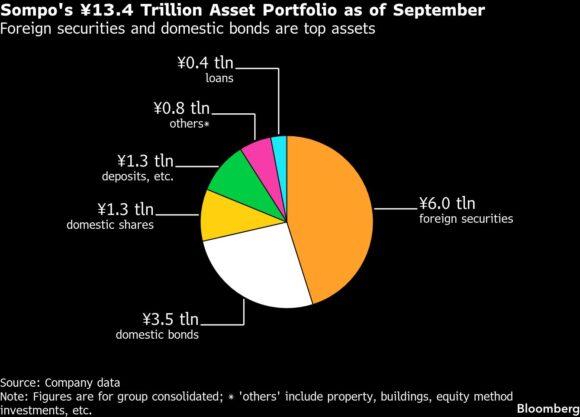

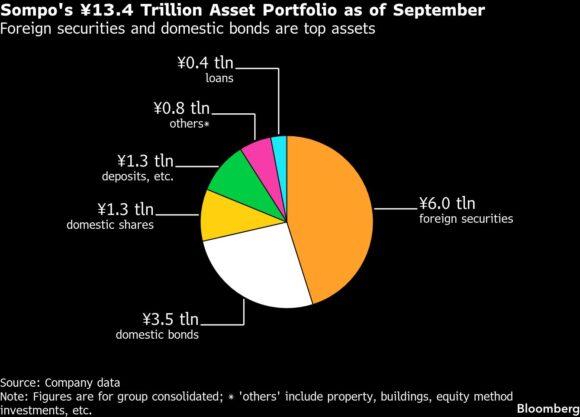

The substantial size of Japan’s non-life insurance sector means that any shift towards riskier, high-yield overseas credit will be closely monitored by investors. As of September last year, Sompo managed ¥13.4 trillion ($85 billion) in assets, the smallest among the top three property and casualty insurers. In comparison, Tokio Marine Holdings Inc. led with approximately ¥31 trillion, while MS&AD Insurance Group Holdings Inc. held around ¥20 trillion, according to industry data.

On a global scale, private credit has evolved into a $1.7 trillion market. Although lending spreads have narrowed due to increasing competition, Sompo finds the debt appealing, as spreads remain wider than those of other credit products. Furthermore, the floating-rate structure allows investors to mitigate risks associated with rising interest rates, according to the company.

Photograph: Sompo Group in Tokyo. Photo credit: Kiyoshi Ota/Bloomberg

Copyright 2026 Bloomberg.

Topics

Carriers

Interested in Carriers?

Get automatic alerts for this topic.

Sompo Holdings Inc. is strategically shifting its focus towards higher-yielding overseas credit investments to enhance profitability, as traditional business avenues face challenges. This move comes as Japan’s third-largest property and casualty insurer grapples with stagnation in its domestic market.

Based in Tokyo, Sompo has recently transitioned several investment managers from its Japan insurance subsidiary to the United States. According to Toshinobu Kondo, the general manager of Sompo’s investment management department, this strategy aims to streamline operations. By selecting the same asset managers for both Japanese and American deals, including private credit and junk bonds, the company hopes to reduce costs.

“We intend to invest broadly in credit assets that offer high profitability and diverse risk-return characteristics,” Kondo stated in an interview. He emphasized that asset management is becoming increasingly vital as a profit source for the insurer, although he refrained from disclosing specific investment targets.

Japanese property and casualty insurers like Sompo are facing difficulties in achieving robust growth within a mature home market. The rapidly aging population is diminishing demand for core products such as auto and home insurance, prompting companies to seek expansion opportunities abroad. Early indicators suggest some success in this direction.

For example, Sompo reported a total operating revenue increase of 4.7% for the fiscal year ending March 2025, largely driven by an 8.6% rise in overseas revenue. In contrast, domestic revenue growth was limited to just 1.9%, with figures remaining nearly flat for the past five years, according to Bloomberg data.

Additionally, a push from policymakers to dismantle cross-shareholdings—often blamed for fostering overly cozy corporate relationships that stifle competition—could provide a temporary boost to insurers. The divestment of these shares has yielded one-off trading profits, although it may reduce future dividend income.

“Further sales of strategic stock holdings and strong underwriting results are the primary profit drivers,” noted Steven Lam, a senior industry analyst at Bloomberg Intelligence, in a recent report.

Natural Disasters

However, insurers pursuing profits through underwriting face significant risks. The increasing frequency of natural disasters poses a challenge, while rising repair costs threaten the auto insurance sector, especially amid the highest inflation rates Japan has seen in decades.

The substantial size of Japan’s non-life insurance sector means that any shift towards riskier, high-yield overseas credit will be closely monitored by investors. As of September last year, Sompo managed ¥13.4 trillion ($85 billion) in assets, the smallest among the top three property and casualty insurers. In comparison, Tokio Marine Holdings Inc. led with approximately ¥31 trillion, while MS&AD Insurance Group Holdings Inc. held around ¥20 trillion, according to industry data.

On a global scale, private credit has evolved into a $1.7 trillion market. Although lending spreads have narrowed due to increasing competition, Sompo finds the debt appealing, as spreads remain wider than those of other credit products. Furthermore, the floating-rate structure allows investors to mitigate risks associated with rising interest rates, according to the company.

Photograph: Sompo Group in Tokyo. Photo credit: Kiyoshi Ota/Bloomberg

Copyright 2026 Bloomberg.

Topics

Carriers

Interested in Carriers?

Get automatic alerts for this topic.