Enhancing P/C Insurer Performance Through Remote Work Strategies

Recent analyses from AM Best and Morgan Stanley have shed light on the evolving landscape of the property and casualty (P/C) insurance industry, particularly regarding expense ratios. AM Best reported a significant 2.4-point decline in expense ratios over the past decade, while Morgan Stanley projects an additional potential drop of 2.0 points by 2030.

Both reports emphasize the transformative role of artificial intelligence (AI) and automation in reducing operational costs. The AM Best report, which provides a historical perspective, also highlights a decrease in rent expenses due to the rise of remote work as a contributing factor.

Examining underwriting ratios from 2014 to 2024, AM Best observed a notable decline in the loss ratio, including a 5.4-point drop in the U.S. P/C insurance industry loss from 2023 to 2024. Over the entire 11-year span, the expense ratio decreased to 25.3 in 2024, down from 27.7 in 2014.

The overall 2.4 percentage point reduction in the long-term underwriting expense ratio for the U.S. P/C insurance segment was largely attributed to a 1.9-point decrease in other acquisition expenses, along with a smaller 0.5-point drop in the general expense ratio, as detailed in AM Best’s special report, “Lower P/C Insurer Expenses Boost Underwriting Results.”

(Editor’s Note: The commission and tax expense components of the expense ratio remained relatively stable throughout the study period. The AM Best report does not include results for 2025.)

The report indicates that this improvement reflects the P/C industry’s advancements through increased digitalization, automation, and the adoption of advanced technologies.

Focusing on the significant 1.9-point decrease in other acquisition expenses, the report notes that the shift from traditional five-day office commitments to hybrid or fully remote work policies has significantly reduced rent-related expenses.

In contrast, the Morgan Stanley report focuses on the future implications of AI on expense ratios and operating margins. Titled “AI (01000001 01001001): How the New Industrial Revolution Is Reinventing Insurance,” it includes analyses of potential earnings growth primarily driven by back-office AI implementation across insurance brokers, P/C insurance carriers, and life insurers.

Notably, Morgan Stanley’s analysis begins with a higher P/C insurance expense ratio of 30.4 for 2026, compared to AM Best’s 25.3 for 2024. This discrepancy likely arises from the different types of carriers monitored by Morgan Stanley, which predominantly include commercial, specialty, and reinsurance companies. The analysts project an expense ratio of 30.5 for 2030 without AI, and 28.5 with AI—indicating a 2-point reduction.

Operating margins are similarly affected, with the Morgan Stanley report forecasting a post-AI operating margin of 17.4 percent for 2030, compared to 15.6 percent without AI—an improvement of nearly 180 basis points.

(Editor’s Note: The analysts calculate a precise 176 basis points of operating margin improvement from AI. Operating margins in the report are expressed as returns on total revenue rather than premiums or operating earnings per share.)

In dollar terms, the report anticipates a $9.3 billion boost from AI implementation in 2030, with projected operating income rising from $82.7 billion without AI to $92.1 billion post-AI. Morgan Stanley describes this 11 percent increase as “operating income uplift.”

These uplifts in operating income and margin basis points reflect comparisons of post-AI and pre-AI results for 2030. Morgan Stanley’s analysis indicates that while initial years may present challenges for P/C insurers, improvements will follow. For instance, in 2026, the post-AI margin for insurers covered by Morgan Stanley research is projected at 14.7 percent, slightly lower than the pre-AI margin of 15.2 percent. The post-AI margin is expected to gradually increase to 17.4 percent by 2030.

Assumptions regarding high AI implementation costs in the early stages and a delayed ramp-up of efficiency benefits significantly influence the 2026 projections. For that year, Morgan Stanley estimates over $6.0 billion in cost savings across the analyzed carriers, with only 10 percent flowing through to operating earnings ($600 million) due to $3.0 billion in implementation costs, resulting in a $2.4 billion drop in operating income.

By 2030, Morgan Stanley anticipates that implementation costs will largely be behind the carriers, allowing for the full realization of the projected $9.3 billion in cost savings.

Improved Carrier Operating Margins

Within the Morgan Stanley coverage universe, carriers such as Assurant, AIG, The Hartford, and Chubb are expected to gain the most in operating margin from increased AI utilization over time. The report includes charts and graphs summarizing workforce data that support these projections.

These charts reveal the “average agentic AI automation rate” across each carrier’s workforce, ranging from 20-21 percent for standard carriers like Travelers, Allstate, and Progressive, to 25-27 percent for specialty providers like Arch Capital Group, Hamilton, and Everest.

The report’s methodology section explains that the analysis begins with gathering task-level agentic AI automation rates, determining the tasks involved in various carrier jobs, and assessing the distribution of jobs across individual carrier workforces. (Refer to the “How Morgan Stanley Developed AI Impact Projections” section for more details on data sources.)

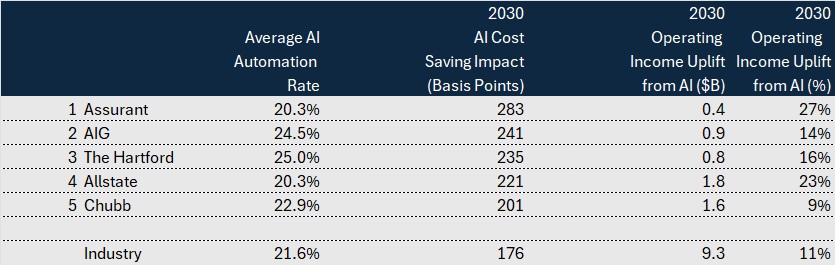

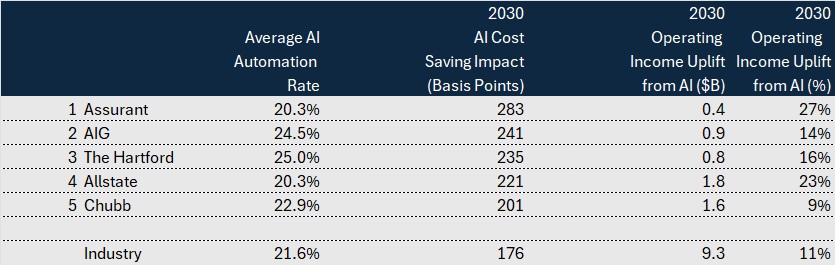

Below, we have excerpted the average automation rates and financial projections for the five P/C carriers that are expected to experience the highest operating margin income uplift by 2030.

These five carriers are projected to account for nearly 60 percent of the anticipated $9 billion-plus industry boost in operating earnings from AI use in 2030, with Progressive and Travelers contributing significantly to the remainder.

Individual carrier rankings in terms of operating margin uplift depend on various factors, including starting assumptions about salaries, headcount, and the estimated percentage of tasks that can be automated through agentic AI. For instance, Chubb’s relatively high pre-AI operating earnings translate to a lower percentage increase from AI compared to specialty carrier Assurant (9 percent for Chubb vs. 27 percent for Assurant).

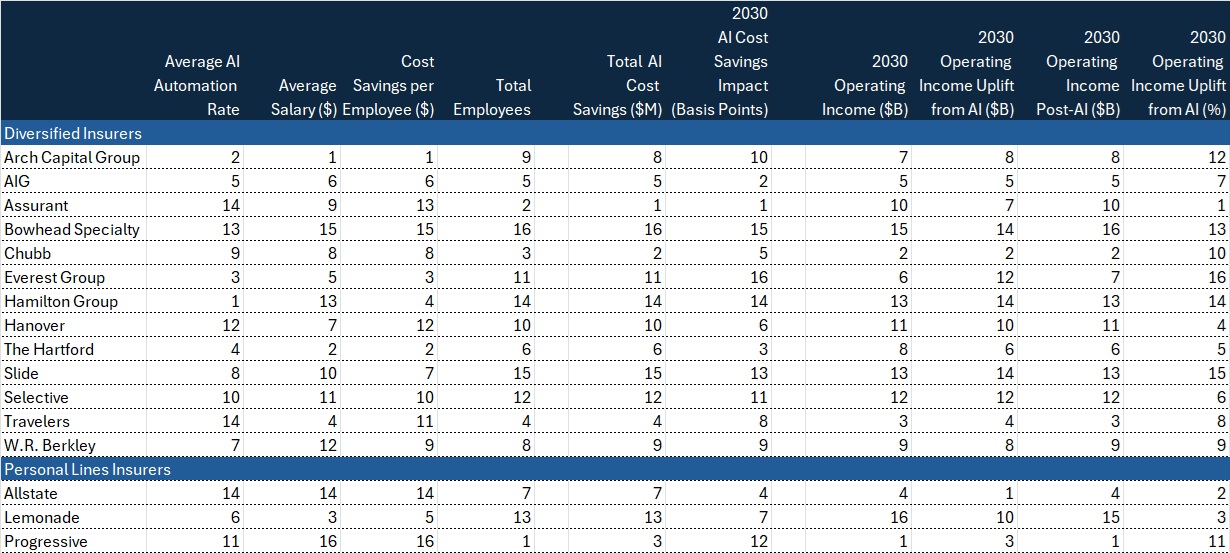

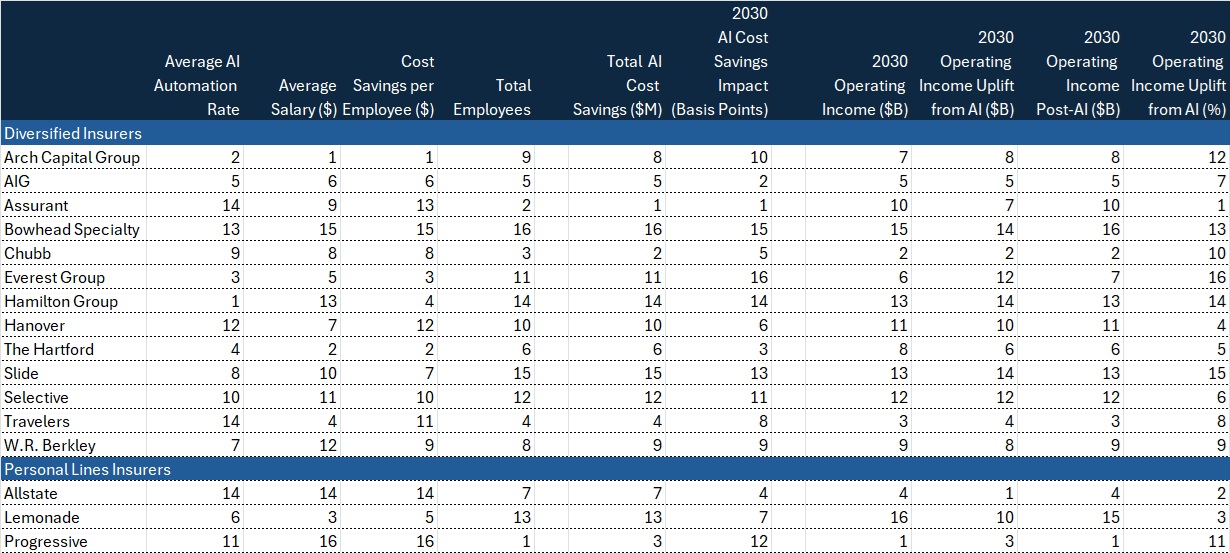

Below, we present the relative rankings of all 16 carriers in the report based on input assumptions and projected AI impacts on 2030 operating earnings (basis point change, dollar change, and percentage change).

When focusing on personal lines insurers, Progressive exhibits a relatively low assumed automation rate (20.7 percent), the lowest average salary (rank 16 of 16 carriers), the largest workforce, and the highest level of pre-AI earnings (rank 1). These factors combine to pull its percentage uplift in 2030 earnings below the overall industry figure (8 percent for Progressive vs. 11 percent for the industry).

Among diversified insurers and reinsurers, Arch Capital Group has the highest average salary and the second-highest assumed agentic AI automation rate (25.7 percent). However, with mid-range operating earnings and workforce counts, Morgan Stanley calculates a 2030 operating earnings uplift from AI for Arch at 6 percent.

What About the Brokers?

The Morgan Stanley report anticipates two key stages of AI adoption for carriers and brokers: an initial phase focused on back-office AI implementation to enhance operational efficiency, primarily affecting expense ratios, followed by a later stage aimed at improving underwriting capabilities, pricing, and driving sales growth. The first stage is the primary focus of the research report.

Additionally, the report evaluates AI’s impact on major P/C brokers like Aon, Marsh, WTW, Brown & Brown, and Ryan Specialty. The analysts note that brokers, similar to carriers, will experience significant benefits from AI adoption over time. However, brokers are currently perceived to be lagging behind P/C carriers in AI implementation. The projected operating margin uplift from AI adoption for brokers is nearly double that of carriers—350 basis points for brokers compared to 180 basis points for carriers.

How Morgan Stanley Developed AI Impact Projections

The report provides a detailed methodology outlining the sources of workforce information and assumptions used in the analysis. For instance, Morgan Stanley utilized Anthropic’s Economic Index data to estimate the percentages of specific insurance professionals’ tasks that can be automated through agentic AI.

Other sources included the Department of Labor’s O*NET database, which mapped potentially automated tasks to specific insurance jobs, and LinkUp job posting data, which helped develop a distribution of jobs across each carrier or broker workforce.

By combining these data points with annual salary information, Morgan Stanley researchers estimated the total potential annual cost savings from agentic AI implementation across the analyzed workforces.

For illustrative purposes, the report details calculations for Aon, noting that the automation rate for insurance sales agents is 21 percent, with an average salary of approximately $82,000, suggesting a potential annual cost savings of $17,000 per agent. Across Aon, the average annual salary for all analyzed professionals exceeds $105,000.

For brokers as a group, the report indicates potential automation rates averaging 25.1 percent across their workforces, while carrier automation rates average 21.6 percent.

The analysts expect the first stage of AI adoption to be a multiyear journey for both carriers and brokers, with expense savings flowing through carrier financials more quickly than those of brokers.

For Aon, for example, Morgan Stanley anticipates it will take five years to achieve 50 percent of AI-driven cost savings, while carrier projections assume 100 percent of AI-driven savings will be realized within five years.

Both groups are expected to focus on developing and experimenting with AI tools over the next two years, resulting in initially negative returns on AI investments before achieving meaningful cost savings and improved bottom lines.

Beyond the projections for carriers and brokers, the report also discusses the historical durability of profit gains achieved by insurers through technology adoption, the frequency of AI-related discussions among insurance executives during earnings calls, historical timelines for technology development and adoption across industries, and other relevant research topics.

Featured image: AI-generated by Copilot

Topics

InsurTech

Carriers

Data Driven

Artificial Intelligence

Property Casualty

Recent analyses from AM Best and Morgan Stanley have shed light on the evolving landscape of the property and casualty (P/C) insurance industry, particularly regarding expense ratios. AM Best reported a significant 2.4-point decline in expense ratios over the past decade, while Morgan Stanley projects an additional potential drop of 2.0 points by 2030.

Both reports emphasize the transformative role of artificial intelligence (AI) and automation in reducing operational costs. The AM Best report, which provides a historical perspective, also highlights a decrease in rent expenses due to the rise of remote work as a contributing factor.

Examining underwriting ratios from 2014 to 2024, AM Best observed a notable decline in the loss ratio, including a 5.4-point drop in the U.S. P/C insurance industry loss from 2023 to 2024. Over the entire 11-year span, the expense ratio decreased to 25.3 in 2024, down from 27.7 in 2014.

The overall 2.4 percentage point reduction in the long-term underwriting expense ratio for the U.S. P/C insurance segment was largely attributed to a 1.9-point decrease in other acquisition expenses, along with a smaller 0.5-point drop in the general expense ratio, as detailed in AM Best’s special report, “Lower P/C Insurer Expenses Boost Underwriting Results.”

(Editor’s Note: The commission and tax expense components of the expense ratio remained relatively stable throughout the study period. The AM Best report does not include results for 2025.)

The report indicates that this improvement reflects the P/C industry’s advancements through increased digitalization, automation, and the adoption of advanced technologies.

Focusing on the significant 1.9-point decrease in other acquisition expenses, the report notes that the shift from traditional five-day office commitments to hybrid or fully remote work policies has significantly reduced rent-related expenses.

In contrast, the Morgan Stanley report focuses on the future implications of AI on expense ratios and operating margins. Titled “AI (01000001 01001001): How the New Industrial Revolution Is Reinventing Insurance,” it includes analyses of potential earnings growth primarily driven by back-office AI implementation across insurance brokers, P/C insurance carriers, and life insurers.

Notably, Morgan Stanley’s analysis begins with a higher P/C insurance expense ratio of 30.4 for 2026, compared to AM Best’s 25.3 for 2024. This discrepancy likely arises from the different types of carriers monitored by Morgan Stanley, which predominantly include commercial, specialty, and reinsurance companies. The analysts project an expense ratio of 30.5 for 2030 without AI, and 28.5 with AI—indicating a 2-point reduction.

Operating margins are similarly affected, with the Morgan Stanley report forecasting a post-AI operating margin of 17.4 percent for 2030, compared to 15.6 percent without AI—an improvement of nearly 180 basis points.

(Editor’s Note: The analysts calculate a precise 176 basis points of operating margin improvement from AI. Operating margins in the report are expressed as returns on total revenue rather than premiums or operating earnings per share.)

In dollar terms, the report anticipates a $9.3 billion boost from AI implementation in 2030, with projected operating income rising from $82.7 billion without AI to $92.1 billion post-AI. Morgan Stanley describes this 11 percent increase as “operating income uplift.”

These uplifts in operating income and margin basis points reflect comparisons of post-AI and pre-AI results for 2030. Morgan Stanley’s analysis indicates that while initial years may present challenges for P/C insurers, improvements will follow. For instance, in 2026, the post-AI margin for insurers covered by Morgan Stanley research is projected at 14.7 percent, slightly lower than the pre-AI margin of 15.2 percent. The post-AI margin is expected to gradually increase to 17.4 percent by 2030.

Assumptions regarding high AI implementation costs in the early stages and a delayed ramp-up of efficiency benefits significantly influence the 2026 projections. For that year, Morgan Stanley estimates over $6.0 billion in cost savings across the analyzed carriers, with only 10 percent flowing through to operating earnings ($600 million) due to $3.0 billion in implementation costs, resulting in a $2.4 billion drop in operating income.

By 2030, Morgan Stanley anticipates that implementation costs will largely be behind the carriers, allowing for the full realization of the projected $9.3 billion in cost savings.

Improved Carrier Operating Margins

Within the Morgan Stanley coverage universe, carriers such as Assurant, AIG, The Hartford, and Chubb are expected to gain the most in operating margin from increased AI utilization over time. The report includes charts and graphs summarizing workforce data that support these projections.

These charts reveal the “average agentic AI automation rate” across each carrier’s workforce, ranging from 20-21 percent for standard carriers like Travelers, Allstate, and Progressive, to 25-27 percent for specialty providers like Arch Capital Group, Hamilton, and Everest.

The report’s methodology section explains that the analysis begins with gathering task-level agentic AI automation rates, determining the tasks involved in various carrier jobs, and assessing the distribution of jobs across individual carrier workforces. (Refer to the “How Morgan Stanley Developed AI Impact Projections” section for more details on data sources.)

Below, we have excerpted the average automation rates and financial projections for the five P/C carriers that are expected to experience the highest operating margin income uplift by 2030.

These five carriers are projected to account for nearly 60 percent of the anticipated $9 billion-plus industry boost in operating earnings from AI use in 2030, with Progressive and Travelers contributing significantly to the remainder.

Individual carrier rankings in terms of operating margin uplift depend on various factors, including starting assumptions about salaries, headcount, and the estimated percentage of tasks that can be automated through agentic AI. For instance, Chubb’s relatively high pre-AI operating earnings translate to a lower percentage increase from AI compared to specialty carrier Assurant (9 percent for Chubb vs. 27 percent for Assurant).

Below, we present the relative rankings of all 16 carriers in the report based on input assumptions and projected AI impacts on 2030 operating earnings (basis point change, dollar change, and percentage change).

When focusing on personal lines insurers, Progressive exhibits a relatively low assumed automation rate (20.7 percent), the lowest average salary (rank 16 of 16 carriers), the largest workforce, and the highest level of pre-AI earnings (rank 1). These factors combine to pull its percentage uplift in 2030 earnings below the overall industry figure (8 percent for Progressive vs. 11 percent for the industry).

Among diversified insurers and reinsurers, Arch Capital Group has the highest average salary and the second-highest assumed agentic AI automation rate (25.7 percent). However, with mid-range operating earnings and workforce counts, Morgan Stanley calculates a 2030 operating earnings uplift from AI for Arch at 6 percent.

What About the Brokers?

The Morgan Stanley report anticipates two key stages of AI adoption for carriers and brokers: an initial phase focused on back-office AI implementation to enhance operational efficiency, primarily affecting expense ratios, followed by a later stage aimed at improving underwriting capabilities, pricing, and driving sales growth. The first stage is the primary focus of the research report.

Additionally, the report evaluates AI’s impact on major P/C brokers like Aon, Marsh, WTW, Brown & Brown, and Ryan Specialty. The analysts note that brokers, similar to carriers, will experience significant benefits from AI adoption over time. However, brokers are currently perceived to be lagging behind P/C carriers in AI implementation. The projected operating margin uplift from AI adoption for brokers is nearly double that of carriers—350 basis points for brokers compared to 180 basis points for carriers.

How Morgan Stanley Developed AI Impact Projections

The report provides a detailed methodology outlining the sources of workforce information and assumptions used in the analysis. For instance, Morgan Stanley utilized Anthropic’s Economic Index data to estimate the percentages of specific insurance professionals’ tasks that can be automated through agentic AI.

Other sources included the Department of Labor’s O*NET database, which mapped potentially automated tasks to specific insurance jobs, and LinkUp job posting data, which helped develop a distribution of jobs across each carrier or broker workforce.

By combining these data points with annual salary information, Morgan Stanley researchers estimated the total potential annual cost savings from agentic AI implementation across the analyzed workforces.

For illustrative purposes, the report details calculations for Aon, noting that the automation rate for insurance sales agents is 21 percent, with an average salary of approximately $82,000, suggesting a potential annual cost savings of $17,000 per agent. Across Aon, the average annual salary for all analyzed professionals exceeds $105,000.

For brokers as a group, the report indicates potential automation rates averaging 25.1 percent across their workforces, while carrier automation rates average 21.6 percent.

The analysts expect the first stage of AI adoption to be a multiyear journey for both carriers and brokers, with expense savings flowing through carrier financials more quickly than those of brokers.

For Aon, for example, Morgan Stanley anticipates it will take five years to achieve 50 percent of AI-driven cost savings, while carrier projections assume 100 percent of AI-driven savings will be realized within five years.

Both groups are expected to focus on developing and experimenting with AI tools over the next two years, resulting in initially negative returns on AI investments before achieving meaningful cost savings and improved bottom lines.

Beyond the projections for carriers and brokers, the report also discusses the historical durability of profit gains achieved by insurers through technology adoption, the frequency of AI-related discussions among insurance executives during earnings calls, historical timelines for technology development and adoption across industries, and other relevant research topics.

Featured image: AI-generated by Copilot

Topics

InsurTech

Carriers

Data Driven

Artificial Intelligence

Property Casualty