Bilt Introduces Three New Credit Card Options

Bilt CEO Ankur Jain and United Wholesale Mortgage CEO Mat Ishbia discuss their new partnership that lets homeowners earn rewards for mortgage payments on ‘The Claman Countdown.’

Bilt, a membership program focused on rewarding consumers for everyday spending, is launching an exciting new lineup of credit cards this Wednesday. These cards are designed not only to enhance the rewards members can earn on housing payments but also to offer a competitive 10% APR for the first year, aimed at improving affordability for consumers.

Introducing Bilt 2.0, a revamped version of the company’s co-branded card program. This iteration features three credit card options, ranging from a no-annual-fee card to a premium card priced at $495. One standout feature, according to CEO Ankur Jain, is that these are the first credit cards available that allow users to pay their rent or mortgage without incurring any transaction fees.

Members will continue to earn rewards for every on-time rent or mortgage payment, aligning with Jain’s mission to make homeownership more accessible, especially during a time when many Americans are struggling to enter the market.

With Bilt 2.0, however, the rewards system has evolved. Instead of earning a flat amount of points on housing payments, the points earned on rent or mortgage payments are now determined by everyday spending. This means that the more frequently cardholders use their cards, the more points they can unlock for their housing payments.

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

Bilt 2.0 is the newest iteration of the company’s credit card. (Bilt)

In addition to rewarding consumers for their everyday purchases, card users will also receive 4% back in Bilt Cash on those purchases, which can be redeemed dollar for dollar. Jain emphasizes that earning points on everyday spending alongside cash back is “unheard of in the market,” making Bilt’s offerings highly competitive.

YOUR NEXT WALGREENS TRIP MAY NOT COST YOU AS MUCH. HERE’S WHY.

Bilt Cash serves as a new rewards currency within Bilt’s ecosystem. Cardholders can earn Bilt Cash through everyday spending, which can then be used for monthly credits at restaurants, hotels, and rideshare services, or to unlock additional points on rent or mortgage payments.

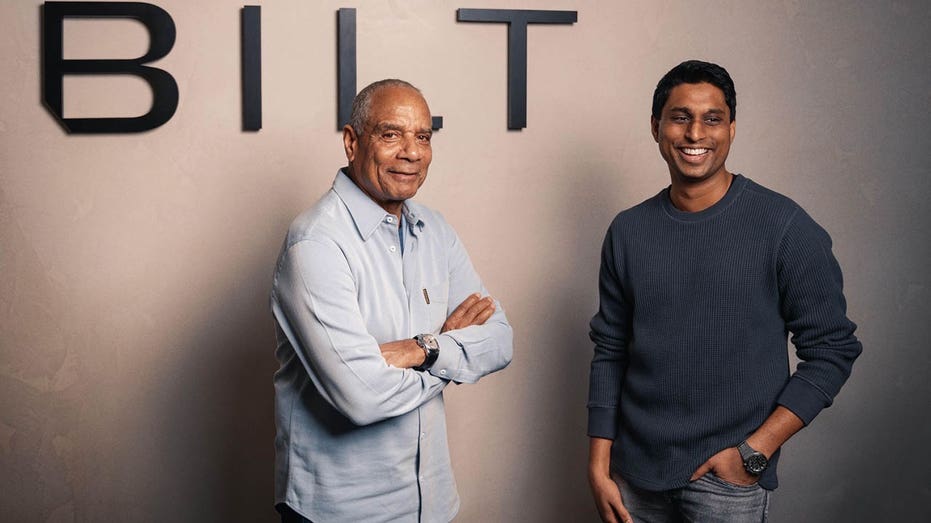

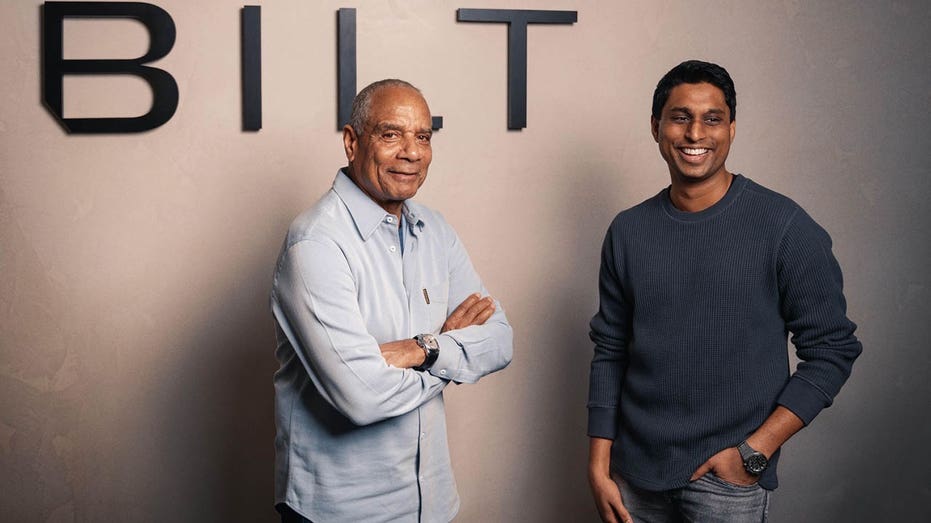

Bilt’s founder Ankur Jain and Chairman Ken Chenault (Bilt)

For housing payments, every $30 in Bilt Cash earned allows cardholders to unlock 1,000 Bilt Points on rent or mortgage payments, applicable even across multiple homes. For instance, a renter paying $3,000 monthly with $60 in Bilt Cash would earn 2,000 points on that payment, all without any transaction fees.

In response to bipartisan calls for affordability, Jain announced that all cardholders will receive a 10% APR on all new purchases for the first year. This initiative aligns with recent proposals, including one from President Donald Trump, advocating for a 10% cap on credit card interest rates for one year, aimed at protecting consumers from exorbitant rates.

“We’ve always been hyper-focused on ensuring the American consumer wins. We offer free credit reporting, points on down payments, and points on student loans. Our goal is to set people up for success, and this initiative allows individuals to manage their balances more effectively over the next 12 months,” Jain stated.

BILT REWARDS LAUNCHES NEW PROGRAM TO HELP WITH STUDENT DEBT

Bilt has consistently emphasized that membership in its rewards program does not require card ownership, but the new cards are designed to enhance engagement within its broader loyalty ecosystem.

Bilt 2.0 is the newest iteration of the company’s credit card.

Current cardholders must select their new Bilt card by January 30, 2026. They will retain the same card number, and their subscriptions and autopay will continue without interruption. The card will also automatically update in Apple Pay and Google Pay.

Here are the cards:

Bilt Blue Card: no annual fee

- 1X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in Bilt Cash upon account opening

- Earn both Bilt Points and Bilt Cash with no annual fee and no foreign transaction fees

Bilt Obsidian Card: $95 annual fee

- 3X points on dining or grocery (grocery up to $25K/year), 2X on travel, 1X on all other everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in annual Bilt Travel Hotel credits

- $200 in Bilt Cash upon approval

- Premium benefits designed for everyday value, including Trip Delay Insurance, no foreign transaction fees

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bilt Palladium Card: $495 annual fee

- 2X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- First-ever, limited-time 50,000-point sign-up bonus + Gold Status (after qualifying spend)

- $300 in additional Bilt Cash upon account opening

- $600 in annual credits ($400 Bilt Travel Hotel credits + $200 in Bilt Cash)

- Additional premium benefits, including Priority Pass access, purchase protection, authorized users

Bilt CEO Ankur Jain and United Wholesale Mortgage CEO Mat Ishbia discuss their new partnership that lets homeowners earn rewards for mortgage payments on ‘The Claman Countdown.’

Bilt, a membership program focused on rewarding consumers for everyday spending, is launching an exciting new lineup of credit cards this Wednesday. These cards are designed not only to enhance the rewards members can earn on housing payments but also to offer a competitive 10% APR for the first year, aimed at improving affordability for consumers.

Introducing Bilt 2.0, a revamped version of the company’s co-branded card program. This iteration features three credit card options, ranging from a no-annual-fee card to a premium card priced at $495. One standout feature, according to CEO Ankur Jain, is that these are the first credit cards available that allow users to pay their rent or mortgage without incurring any transaction fees.

Members will continue to earn rewards for every on-time rent or mortgage payment, aligning with Jain’s mission to make homeownership more accessible, especially during a time when many Americans are struggling to enter the market.

With Bilt 2.0, however, the rewards system has evolved. Instead of earning a flat amount of points on housing payments, the points earned on rent or mortgage payments are now determined by everyday spending. This means that the more frequently cardholders use their cards, the more points they can unlock for their housing payments.

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

Bilt 2.0 is the newest iteration of the company’s credit card. (Bilt)

In addition to rewarding consumers for their everyday purchases, card users will also receive 4% back in Bilt Cash on those purchases, which can be redeemed dollar for dollar. Jain emphasizes that earning points on everyday spending alongside cash back is “unheard of in the market,” making Bilt’s offerings highly competitive.

YOUR NEXT WALGREENS TRIP MAY NOT COST YOU AS MUCH. HERE’S WHY.

Bilt Cash serves as a new rewards currency within Bilt’s ecosystem. Cardholders can earn Bilt Cash through everyday spending, which can then be used for monthly credits at restaurants, hotels, and rideshare services, or to unlock additional points on rent or mortgage payments.

Bilt’s founder Ankur Jain and Chairman Ken Chenault (Bilt)

For housing payments, every $30 in Bilt Cash earned allows cardholders to unlock 1,000 Bilt Points on rent or mortgage payments, applicable even across multiple homes. For instance, a renter paying $3,000 monthly with $60 in Bilt Cash would earn 2,000 points on that payment, all without any transaction fees.

In response to bipartisan calls for affordability, Jain announced that all cardholders will receive a 10% APR on all new purchases for the first year. This initiative aligns with recent proposals, including one from President Donald Trump, advocating for a 10% cap on credit card interest rates for one year, aimed at protecting consumers from exorbitant rates.

“We’ve always been hyper-focused on ensuring the American consumer wins. We offer free credit reporting, points on down payments, and points on student loans. Our goal is to set people up for success, and this initiative allows individuals to manage their balances more effectively over the next 12 months,” Jain stated.

BILT REWARDS LAUNCHES NEW PROGRAM TO HELP WITH STUDENT DEBT

Bilt has consistently emphasized that membership in its rewards program does not require card ownership, but the new cards are designed to enhance engagement within its broader loyalty ecosystem.

Bilt 2.0 is the newest iteration of the company’s credit card.

Current cardholders must select their new Bilt card by January 30, 2026. They will retain the same card number, and their subscriptions and autopay will continue without interruption. The card will also automatically update in Apple Pay and Google Pay.

Here are the cards:

Bilt Blue Card: no annual fee

- 1X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in Bilt Cash upon account opening

- Earn both Bilt Points and Bilt Cash with no annual fee and no foreign transaction fees

Bilt Obsidian Card: $95 annual fee

- 3X points on dining or grocery (grocery up to $25K/year), 2X on travel, 1X on all other everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in annual Bilt Travel Hotel credits

- $200 in Bilt Cash upon approval

- Premium benefits designed for everyday value, including Trip Delay Insurance, no foreign transaction fees

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bilt Palladium Card: $495 annual fee

- 2X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- First-ever, limited-time 50,000-point sign-up bonus + Gold Status (after qualifying spend)

- $300 in additional Bilt Cash upon account opening

- $600 in annual credits ($400 Bilt Travel Hotel credits + $200 in Bilt Cash)

- Additional premium benefits, including Priority Pass access, purchase protection, authorized users