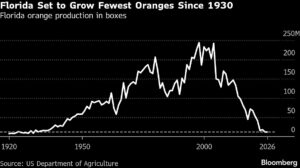

Florida Approaches Its Smallest Orange Crop in Almost a Century

Florida’s orange harvest is projected to decline to its lowest level in nearly a century, as diminishing groves continue to counterbalance any improvements in yields. According to the US Department of Agriculture’s initial forecast for the 2025-26 season, the state is expected to produce just 12 million boxes of fruit, marking a 2% decrease from the previous year. This output is the lowest since 1930 and is attributed to the ongoing removal of Florida’s historic orange groves, which have suffered from years of disease and the devastating effects of Hurricane Milton at the end of 2024.

The production of Florida’s iconic fruit has sharply declined since the early 2000s, primarily due to the impact of citrus greening disease, which has ravaged many groves. Although new treatments have shown promise in recovering some infected trees, these advancements have not been sufficient to offset the extensive loss of acreage.

Any potential recovery in overall production appears to be a distant prospect. Producers may plant between two to five million new trees this year, following Florida’s approval of nearly $140 million for the citrus industry in its 2025-26 budget. Marisa Zansler, director of economic and market research at the state’s Department of Citrus, noted that these new trees will require three to five years before they begin to bear fruit.

“It’ll be a process to see the overall fruit count increase,” stated Matt Joyner, chief executive officer of Florida Citrus Mutual. “That’s going to take a number of years to get that broader number up.”

However, US consumers may not have to wait long for retail prices to stabilize. Orange juice futures have already plummeted more than 60% from a record high in December 2024, as Brazil, the leading orange juice producer, anticipates a rebound in production for the 2025-26 season following its worst crop in 36 years. On Monday, the most-active contract in New York saw a significant drop of 7.4%, marking the largest decline in over two months, settling at $1.8865 per pound.

Additionally, more of Florida’s oranges could soon be making their way into American juice bottles, as the US in November lowered the minimum sugar content requirement for pasteurized orange juice.

Most of Florida’s oranges are destined for juicing, while California, the top citrus state, focuses more on fresh fruit production. California’s output is projected to increase by 1% year-over-year to 45.5 million boxes in the 2025-26 season, which will help maintain overall US production at a relatively stable level, according to the USDA.

Top photo: Workers sort navel oranges at a packing facility in Vero Beach, Florida. (Eve Edelheit/Bloomberg)

Topics

Florida

Agribusiness

Interested in Agribusiness?

Get automatic alerts for this topic.

Florida’s orange harvest is projected to decline to its lowest level in nearly a century, as diminishing groves continue to counterbalance any improvements in yields. According to the US Department of Agriculture’s initial forecast for the 2025-26 season, the state is expected to produce just 12 million boxes of fruit, marking a 2% decrease from the previous year. This output is the lowest since 1930 and is attributed to the ongoing removal of Florida’s historic orange groves, which have suffered from years of disease and the devastating effects of Hurricane Milton at the end of 2024.

The production of Florida’s iconic fruit has sharply declined since the early 2000s, primarily due to the impact of citrus greening disease, which has ravaged many groves. Although new treatments have shown promise in recovering some infected trees, these advancements have not been sufficient to offset the extensive loss of acreage.

Any potential recovery in overall production appears to be a distant prospect. Producers may plant between two to five million new trees this year, following Florida’s approval of nearly $140 million for the citrus industry in its 2025-26 budget. Marisa Zansler, director of economic and market research at the state’s Department of Citrus, noted that these new trees will require three to five years before they begin to bear fruit.

“It’ll be a process to see the overall fruit count increase,” stated Matt Joyner, chief executive officer of Florida Citrus Mutual. “That’s going to take a number of years to get that broader number up.”

However, US consumers may not have to wait long for retail prices to stabilize. Orange juice futures have already plummeted more than 60% from a record high in December 2024, as Brazil, the leading orange juice producer, anticipates a rebound in production for the 2025-26 season following its worst crop in 36 years. On Monday, the most-active contract in New York saw a significant drop of 7.4%, marking the largest decline in over two months, settling at $1.8865 per pound.

Additionally, more of Florida’s oranges could soon be making their way into American juice bottles, as the US in November lowered the minimum sugar content requirement for pasteurized orange juice.

Most of Florida’s oranges are destined for juicing, while California, the top citrus state, focuses more on fresh fruit production. California’s output is projected to increase by 1% year-over-year to 45.5 million boxes in the 2025-26 season, which will help maintain overall US production at a relatively stable level, according to the USDA.

Top photo: Workers sort navel oranges at a packing facility in Vero Beach, Florida. (Eve Edelheit/Bloomberg)

Topics

Florida

Agribusiness

Interested in Agribusiness?

Get automatic alerts for this topic.