Former PIMCO Executive Achieves Milestone with Launch of Catastrophe Bond ETF

An innovative exchange-traded fund (ETF) focused on natural disaster-related investments has officially begun trading in London. This marks a significant milestone as it is the first ETF of its kind to secure a lead market maker.

The KRC Cat Bond UCITS ETF aims to attract more retail investors to the burgeoning market for catastrophe bonds. According to Rick Pagnani, the chief executive of King Ridge Capital Advisors, the firm behind the ETF, the initiative is designed to make catastrophe bonds more accessible to the general public. King Ridge, co-founded by Pagnani in 2024 after his tenure at Pacific Investment Management Co., has partnered with London-based Goldenberg Hehmeyer LLP as its lead market maker.

“We want to make catastrophe bonds accessible to the general public,” Pagnani stated in a recent interview. The market for cat bonds has experienced remarkable growth in recent years, driven by the increasing frequency and severity of natural disasters, which have led to insured losses that far exceed historical averages. As a result, insurers and reinsurers are increasingly offloading portions of their risk to capital markets to mitigate their exposure. Investors in these bonds earn returns if a specified catastrophe does not occur.

Recently, cat bond investors have largely avoided significant payouts, thanks to sophisticated models that only trigger payouts after certain loss thresholds are crossed.

Read more: Catastrophe Bonds’ Huge Market Gains Put Reinsurers on Backfoot

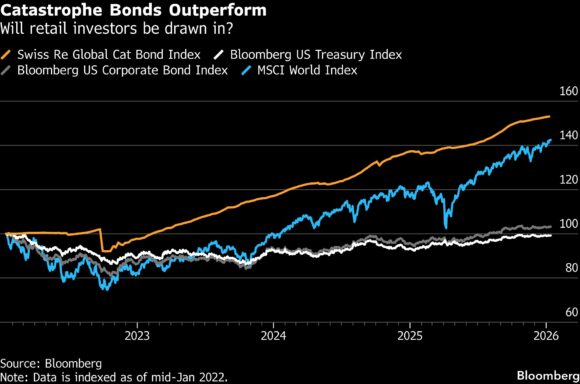

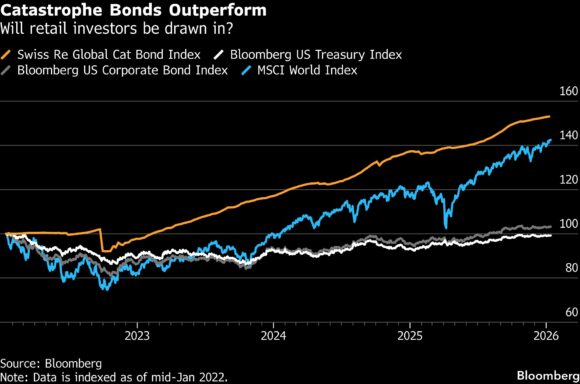

Over the past four years, the Swiss Re index tracking cat bonds has surged by more than 50%, outperforming the MSCI World Index during the same period. Even in 2022, when Hurricane Ian inflicted substantial losses in Florida, the Swiss Re index only saw a minor dip of about 2%.

King Ridge’s ETF, which commenced trading in London on Tuesday, represents a significant achievement. A similar ETF launched in New York in April—dubbed the Brookmont Catastrophic Bond ETF—failed to secure a lead market maker. Despite this, it has attracted approximately $36 million in investor capital.

Pagnani noted that initial uncertainties surrounding the US ETF have since diminished, allowing it to surpass its break-even point of $25 million. This stability is a key factor in Goldenberg Hehmeyer’s decision to take on the lead market maker role for the European ETF.

“Europe has been at the forefront of cat bond investments compared to the US, creating opportunities for such funds to reach a broader range of investors,” Pagnani explained. Although the new ETF, domiciled in Ireland and also trading in Frankfurt and Milan, has attracted only $3 million so far, Pagnani is optimistic it will soon reach its $25 million break-even target.

“We’re not going anywhere,” he asserted, emphasizing that the firm has ample reserves to remain competitive. However, the fund’s current small size does expose it to sudden price fluctuations, as evidenced by a 3.8% drop on Thursday, according to Bloomberg data.

Read More: Catastrophe Bonds Linked to Wildfires Lose ‘Untouchable’ Status

The cat bond market reached an all-time high of approximately $60 billion last year, following record issuance. However, the cost of catastrophe protection has risen, now exceeding realized losses, as noted in an analysis by the Anthropocene Fixed Income Institute.

According to Josephine Richardson, head of research at AFII, “markets are anticipating more severe losses ahead.” She also highlighted that “cat bonds have provided the most attractive risk-adjusted returns, even surpassing those of the US equity market,” before considering liquidity factors.

As a result, retail investors are increasingly entering the market. The value of cat bonds in UCITS-labeled funds—designed to protect retail investors—rose nearly 40% last year to $19 billion, according to Artemis, a data provider tracking insurance-linked securities.

This surge in retail interest has prompted regulators to scrutinize the market more closely. The European Securities and Markets Authority (ESMA) has expressed concerns that cat bonds may not be suitable for retail investors due to their complexity. The decision now rests with the European Commission.

These warnings led Brookmont to abandon its plans for a cat bond ETF in Europe. However, Pagnani remains undeterred by ESMA’s recommendations, stating, “We believed the risk was worth taking, given the market opportunity.”

What Bloomberg Intelligence Says…

A glut of alternative capital in the reinsurance market is setting up a more volatile 2026 for catastrophe-bond investors, with market pricing suggesting an upside return of 7%, a 6.3% yield, and 0.7% of potential spread compression. Cat bonds may struggle on a relative-value basis since insurer risk spreads are trading below high-yield peers.

Photograph: The destroyed neighborhood of North Street following the passage of Hurricane Melissa in Black River, Jamaica on Oct. 29, 2025. Photo credit: Ricardo Makyn/AFP/Getty Images

Related:

Copyright 2026 Bloomberg.

Topics

Catastrophe

Interested in Catastrophe?

Get automatic alerts for this topic.

An innovative exchange-traded fund (ETF) focused on natural disaster-related investments has officially begun trading in London. This marks a significant milestone as it is the first ETF of its kind to secure a lead market maker.

The KRC Cat Bond UCITS ETF aims to attract more retail investors to the burgeoning market for catastrophe bonds. According to Rick Pagnani, the chief executive of King Ridge Capital Advisors, the firm behind the ETF, the initiative is designed to make catastrophe bonds more accessible to the general public. King Ridge, co-founded by Pagnani in 2024 after his tenure at Pacific Investment Management Co., has partnered with London-based Goldenberg Hehmeyer LLP as its lead market maker.

“We want to make catastrophe bonds accessible to the general public,” Pagnani stated in a recent interview. The market for cat bonds has experienced remarkable growth in recent years, driven by the increasing frequency and severity of natural disasters, which have led to insured losses that far exceed historical averages. As a result, insurers and reinsurers are increasingly offloading portions of their risk to capital markets to mitigate their exposure. Investors in these bonds earn returns if a specified catastrophe does not occur.

Recently, cat bond investors have largely avoided significant payouts, thanks to sophisticated models that only trigger payouts after certain loss thresholds are crossed.

Read more: Catastrophe Bonds’ Huge Market Gains Put Reinsurers on Backfoot

Over the past four years, the Swiss Re index tracking cat bonds has surged by more than 50%, outperforming the MSCI World Index during the same period. Even in 2022, when Hurricane Ian inflicted substantial losses in Florida, the Swiss Re index only saw a minor dip of about 2%.

King Ridge’s ETF, which commenced trading in London on Tuesday, represents a significant achievement. A similar ETF launched in New York in April—dubbed the Brookmont Catastrophic Bond ETF—failed to secure a lead market maker. Despite this, it has attracted approximately $36 million in investor capital.

Pagnani noted that initial uncertainties surrounding the US ETF have since diminished, allowing it to surpass its break-even point of $25 million. This stability is a key factor in Goldenberg Hehmeyer’s decision to take on the lead market maker role for the European ETF.

“Europe has been at the forefront of cat bond investments compared to the US, creating opportunities for such funds to reach a broader range of investors,” Pagnani explained. Although the new ETF, domiciled in Ireland and also trading in Frankfurt and Milan, has attracted only $3 million so far, Pagnani is optimistic it will soon reach its $25 million break-even target.

“We’re not going anywhere,” he asserted, emphasizing that the firm has ample reserves to remain competitive. However, the fund’s current small size does expose it to sudden price fluctuations, as evidenced by a 3.8% drop on Thursday, according to Bloomberg data.

Read More: Catastrophe Bonds Linked to Wildfires Lose ‘Untouchable’ Status

The cat bond market reached an all-time high of approximately $60 billion last year, following record issuance. However, the cost of catastrophe protection has risen, now exceeding realized losses, as noted in an analysis by the Anthropocene Fixed Income Institute.

According to Josephine Richardson, head of research at AFII, “markets are anticipating more severe losses ahead.” She also highlighted that “cat bonds have provided the most attractive risk-adjusted returns, even surpassing those of the US equity market,” before considering liquidity factors.

As a result, retail investors are increasingly entering the market. The value of cat bonds in UCITS-labeled funds—designed to protect retail investors—rose nearly 40% last year to $19 billion, according to Artemis, a data provider tracking insurance-linked securities.

This surge in retail interest has prompted regulators to scrutinize the market more closely. The European Securities and Markets Authority (ESMA) has expressed concerns that cat bonds may not be suitable for retail investors due to their complexity. The decision now rests with the European Commission.

These warnings led Brookmont to abandon its plans for a cat bond ETF in Europe. However, Pagnani remains undeterred by ESMA’s recommendations, stating, “We believed the risk was worth taking, given the market opportunity.”

What Bloomberg Intelligence Says…

A glut of alternative capital in the reinsurance market is setting up a more volatile 2026 for catastrophe-bond investors, with market pricing suggesting an upside return of 7%, a 6.3% yield, and 0.7% of potential spread compression. Cat bonds may struggle on a relative-value basis since insurer risk spreads are trading below high-yield peers.

Photograph: The destroyed neighborhood of North Street following the passage of Hurricane Melissa in Black River, Jamaica on Oct. 29, 2025. Photo credit: Ricardo Makyn/AFP/Getty Images

Related:

Copyright 2026 Bloomberg.

Topics

Catastrophe

Interested in Catastrophe?

Get automatic alerts for this topic.