How Your Medicare Insurance Plan Pays for Your Home Health Care Services – Senior Home Care HQ

After a hospital stay or significant surgical procedure, medical professionals often recommend home health care services. These services facilitate a smoother transition from hospital discharge to independent living at home.

Home health care encompasses a range of prescribed healthcare assistance delivered by clinicians who visit your home to address medical, rehabilitative, and household management needs.

Services may include social work, nursing, physical therapy, occupational therapy, speech therapy, respiratory therapy, home health aides, and other medically necessary services designed to help individuals thrive at home.

A common question arises: who pays for home health care? With escalating healthcare costs, out-of-pocket payments can be burdensome. Fortunately, depending on individual circumstances, various medical insurances may offer partial or full coverage for home health care services.

This article will focus on Medicare, detailing which home health care services are covered and not covered by Medicare, expected out-of-pocket costs, what a notice of non-coverage entails, and steps to take if you believe services are ending prematurely.

Understanding Medicare Plans: Original vs. Medicare Advantage

First, identify your Medicare plan. Original Medicare consists of parts: Part A, Part B, and Part D. Part A covers hospital stays and specific skilled services, Part B covers medical equipment and home health care services, while Part D addresses prescription medications.

Medicare Advantage plans encompass these parts collectively, offering either partial or full coverage based on the services and equipment required.

Home Health Care Services Covered by Medicare

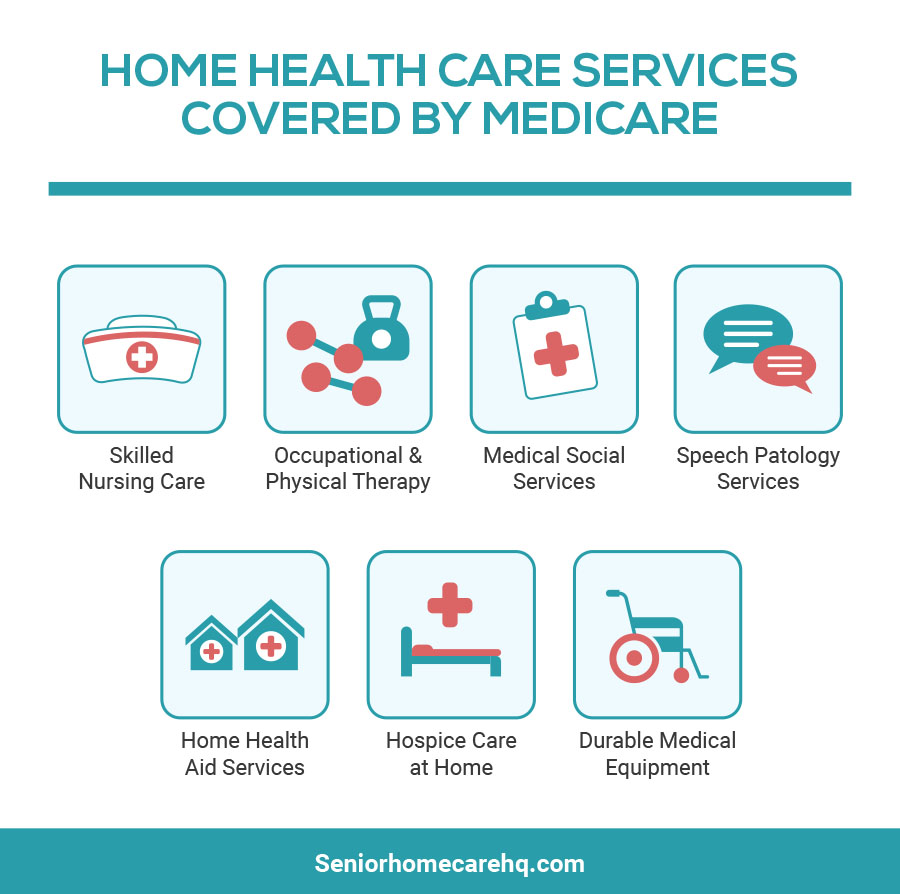

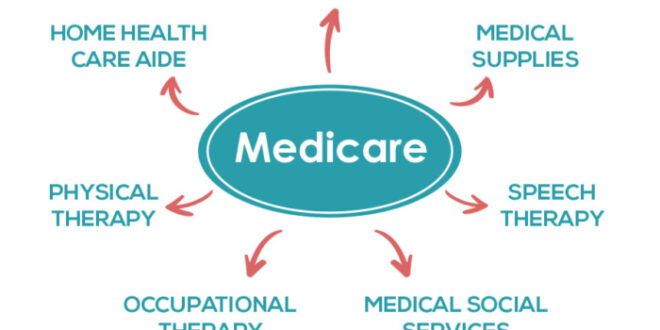

If deemed reasonable and medically necessary for recovery, Medicare (Part B) covers the following services:

[su_service title=”Skilled Nursing Care” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]IV drug administration, medical injections, tube feedings, dressing changes, prescriptive drug education, or any services requiring a licensed or registered nurse.

[su_service title=”Rehabilitation Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Physical, occupational, and/or speech therapy for patients needing assistance to improve mobility and daily living tasks.

[su_service title=”In-Home Health Aide Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Personnel assisting with non-medical tasks such as bathing, dressing, feeding, and some household chores.

[su_service title=”Social Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Social workers or counselors addressing social and emotional concerns and providing community resources.

[su_service title=”Medical Supplies” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Medicare covers supplies like wound dressings. Durable Medical Equipment (DME) is also covered but billed separately, including wheelchairs, walkers, oxygen tanks, and crutches. DME falls under Medicare Plan B.

[su_service title=”Prescription Drugs” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]If your Medicare plan covers prescription medication (Medicare Plan D), you may receive partial to full coverage for specific drugs prescribed by your doctor.

Home Care Services Not Covered by Medicare

Medicare does NOT cover the following home health care services:

[su_service title=”24-Hour Care at Home” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Nursing, rehabilitative, social, and in-home personnel are only available for a designated number of hours per week, as determined by your doctor and Medicare’s medical necessity criteria.

[su_service title=”Homemaker Services” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Tasks such as laundry, cleaning, and running errands.

[su_service title=”Meal Delivery” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Having meals delivered to your home.

[su_service title=”Custodial or Personal Care” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Non-medical assistance with personal care (bathing, dressing, toileting, etc.).

[su_service title=”Limited Nursing Visits” icon=”icon: remove” icon_color=”#cc270b”][/su_service] For instance, Medicare won’t cover a skilled nursing visit solely for a blood draw.

[su_service title=”Adaptive Equipment” icon=”icon: remove” icon_color=”#cc270b”] While Medicare covers durable medical equipment (DME), it does not cover adaptive equipment (shower chairs, shoe horns, reachers, etc.).

Out-of-Pocket Costs for Non-Covered Services

Before commencing home health care services, patients should receive information regarding expected bills and out-of-pocket expenses.

While some services may be fully covered, others, including specific DME, may only be covered up to 80%, leaving patients responsible for the remaining 20% of costs.

Patients will also need to cover the full cost of services not included in their Medicare coverage as outlined in the insurance contract.

Understanding the Notice of Non-Coverage

A Notice of Noncoverage, or “Advance Beneficiary Notice of Noncoverage (ABN)”, informs patients about services that may not be covered by Medicare. Reasons for non-coverage may include:

- The service isn’t medically necessary

- The patient doesn’t meet the criteria for home health care services

- The service is non-skilled

Patients should receive this notice prior to the start of home health care services to avoid unexpected out-of-pocket expenses.

Steps to Take If You Believe Services Are Ending Too Soon

Your home health care agency should provide a notice a few days in advance if services are concluding. If you don’t receive this notice, request it.

This notice will detail why services are ending and how to apply for a fast appeal if you believe they are terminating prematurely.

During the fast appeal process, a Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) reviews your case to determine if your home health care services should be extended.

This organization will inquire about your reasons for wanting continued services, review your medical records, and consult with your primary physician.

Typically, the BFCC-QIO will provide a decision within three days. If you do not initiate a fast appeal before your services conclude, your home health care agency must send you a Notice of Noncoverage.

Filing Complaints About Home Health Care Services

If you have concerns regarding the quality of care from a home health agency, you should contact:

- Your state home health hotline, which your agency should provide when you begin services.

- The Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) in your state. For the contact number, visit Medicare.gov or call 1-800-MEDICARE.

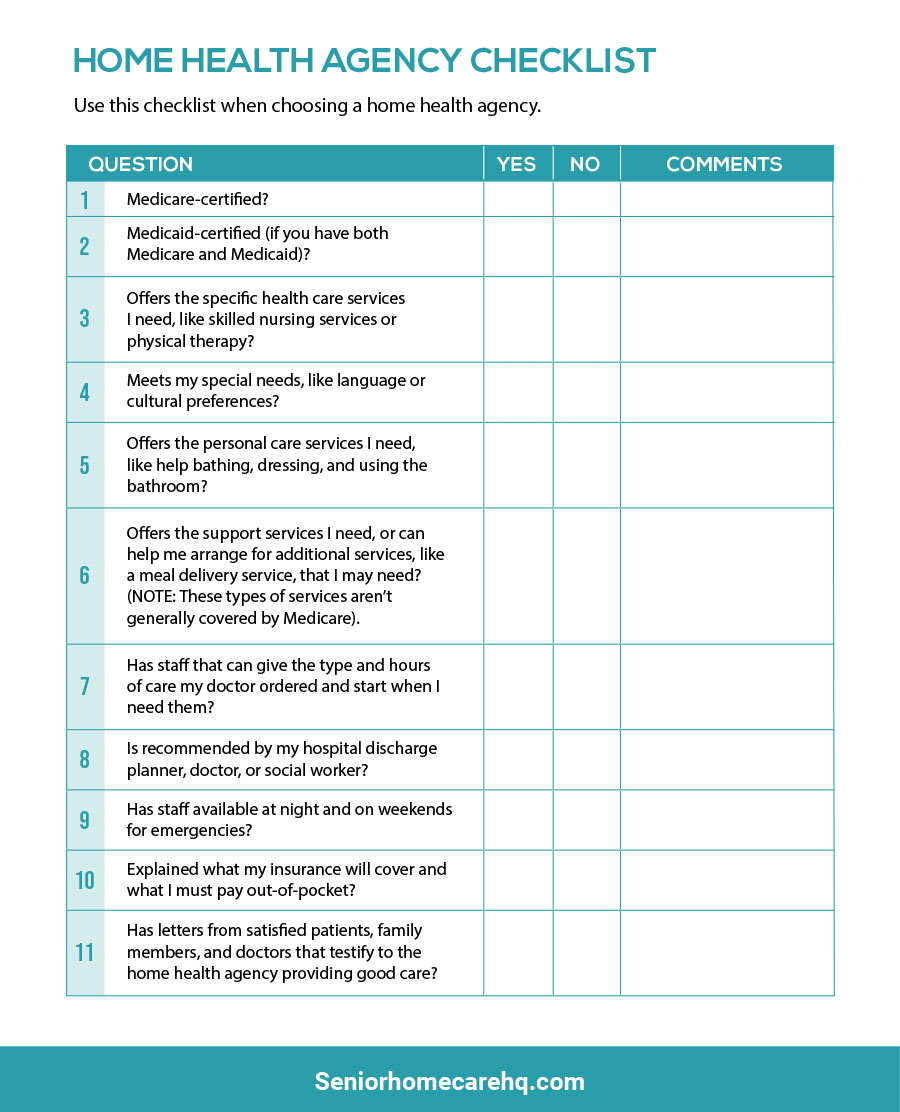

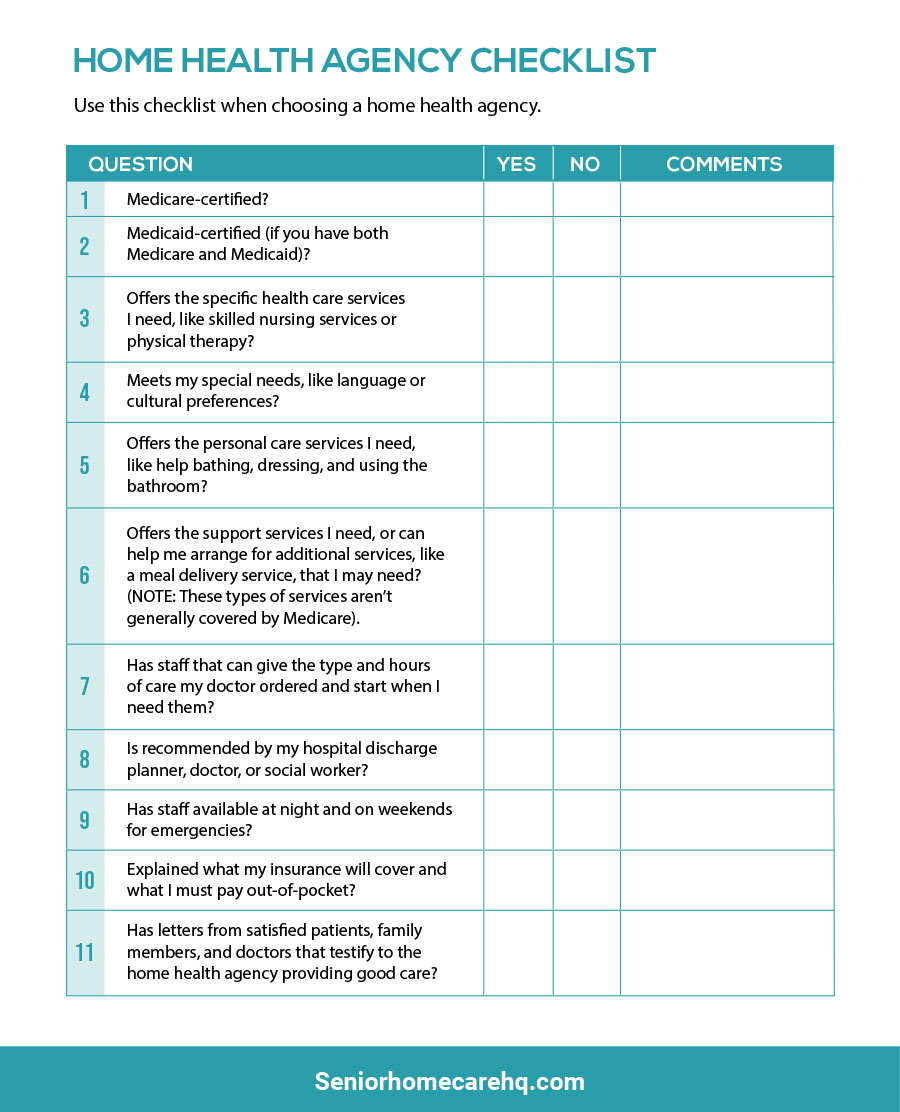

Home Health Care Service Provider Checklist

This checklist can assist you and your family or friends in monitoring your home health care. Use it to ensure you receive quality care.

A Few Tips for Navigating Home Health Care Services and Medicare Coverage

If you require home health care services and are new to the process, familiarize yourself with your current medical insurance plan and its coverage.

Differentiate between Original Medicare and Medicare Advantage to understand the coverage available for your desired in-home services.

Maintain communication with your home health agency to ensure timely issuance of necessary notices, preventing unexpected out-of-pocket expenses. For more information, visit the Medicare website regarding home health care coverage.

Contact Information for Medicare Coverage Questions

If you have inquiries about your Medicare home health care benefits and you have Original Medicare, visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227).

If you receive Medicare benefits through a Medicare Advantage Plan (Part C) or another Medicare health plan, contact your plan directly. You may also reach out to the State Health Insurance Assistance Program (SHIP).

SHIP counselors can answer questions about Medicare’s home health benefits and coverage provided by Medicare, Medicaid, and other insurance types. To find your SHIP’s contact number, visit shiptacenter.org or call 1-800-MEDICARE.

Frequently Asked Questions

#1 Question: Who qualifies for home health care services?

Answer: To qualify, you must be homebound, certified by a doctor. Being homebound means you have difficulty leaving home without assistance due to an illness or injury, or it’s not advisable for you to leave due to your condition.

#2 Question: What home health services are covered by Medicare?

Answer: Medicare covers Skilled Nursing Care, Physical Therapy, Occupational Therapy, Speech-Language Pathology Services, Home Health Aide Services, Medical Social Services, and Medical Supplies.

#3 Question: What happens after a doctor refers you for home health care services?

Answer: You will choose an agency from the Medicare-certified home health agencies in your area. Your hospital discharge planner or referring agency should assist you while respecting your choices, although availability and insurance coverage may limit your options.

#4 Question: What is a Plan of Care, and does your home health care service agency provide this?

Answer: A Plan of Care outlines the services and care you should receive based on your medical condition. It includes the services required, health professionals involved, frequency of care, visiting schedule, necessary medical equipment, and expected treatment outcomes. This is typically established during your first visit with the home health care agency.

#5 Question: What is the best way to choose a Medicare-approved home care service agency?

Answer: Refer to this article on the 7 tips to finding a good Medicare Approved Home Health Care Agency.

#6 Question: How long will Medicare pay for home health care?

Answer: Medicare will cover home health care as long as you meet specific conditions, such as requiring skilled nursing or therapy services and being homebound. There is no set time limit for coverage, as it varies based on individual needs and progress. Regularly review your care plan with your healthcare provider and home health agency to ensure continued necessity and coverage.

After a hospital stay or significant surgical procedure, medical professionals often recommend home health care services. These services facilitate a smoother transition from hospital discharge to independent living at home.

Home health care encompasses a range of prescribed healthcare assistance delivered by clinicians who visit your home to address medical, rehabilitative, and household management needs.

Services may include social work, nursing, physical therapy, occupational therapy, speech therapy, respiratory therapy, home health aides, and other medically necessary services designed to help individuals thrive at home.

A common question arises: who pays for home health care? With escalating healthcare costs, out-of-pocket payments can be burdensome. Fortunately, depending on individual circumstances, various medical insurances may offer partial or full coverage for home health care services.

This article will focus on Medicare, detailing which home health care services are covered and not covered by Medicare, expected out-of-pocket costs, what a notice of non-coverage entails, and steps to take if you believe services are ending prematurely.

Understanding Medicare Plans: Original vs. Medicare Advantage

First, identify your Medicare plan. Original Medicare consists of parts: Part A, Part B, and Part D. Part A covers hospital stays and specific skilled services, Part B covers medical equipment and home health care services, while Part D addresses prescription medications.

Medicare Advantage plans encompass these parts collectively, offering either partial or full coverage based on the services and equipment required.

Home Health Care Services Covered by Medicare

If deemed reasonable and medically necessary for recovery, Medicare (Part B) covers the following services:

[su_service title=”Skilled Nursing Care” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]IV drug administration, medical injections, tube feedings, dressing changes, prescriptive drug education, or any services requiring a licensed or registered nurse.

[su_service title=”Rehabilitation Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Physical, occupational, and/or speech therapy for patients needing assistance to improve mobility and daily living tasks.

[su_service title=”In-Home Health Aide Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Personnel assisting with non-medical tasks such as bathing, dressing, feeding, and some household chores.

[su_service title=”Social Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Social workers or counselors addressing social and emotional concerns and providing community resources.

[su_service title=”Medical Supplies” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Medicare covers supplies like wound dressings. Durable Medical Equipment (DME) is also covered but billed separately, including wheelchairs, walkers, oxygen tanks, and crutches. DME falls under Medicare Plan B.

[su_service title=”Prescription Drugs” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]If your Medicare plan covers prescription medication (Medicare Plan D), you may receive partial to full coverage for specific drugs prescribed by your doctor.

Home Care Services Not Covered by Medicare

Medicare does NOT cover the following home health care services:

[su_service title=”24-Hour Care at Home” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Nursing, rehabilitative, social, and in-home personnel are only available for a designated number of hours per week, as determined by your doctor and Medicare’s medical necessity criteria.

[su_service title=”Homemaker Services” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Tasks such as laundry, cleaning, and running errands.

[su_service title=”Meal Delivery” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Having meals delivered to your home.

[su_service title=”Custodial or Personal Care” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Non-medical assistance with personal care (bathing, dressing, toileting, etc.).

[su_service title=”Limited Nursing Visits” icon=”icon: remove” icon_color=”#cc270b”][/su_service] For instance, Medicare won’t cover a skilled nursing visit solely for a blood draw.

[su_service title=”Adaptive Equipment” icon=”icon: remove” icon_color=”#cc270b”] While Medicare covers durable medical equipment (DME), it does not cover adaptive equipment (shower chairs, shoe horns, reachers, etc.).

Out-of-Pocket Costs for Non-Covered Services

Before commencing home health care services, patients should receive information regarding expected bills and out-of-pocket expenses.

While some services may be fully covered, others, including specific DME, may only be covered up to 80%, leaving patients responsible for the remaining 20% of costs.

Patients will also need to cover the full cost of services not included in their Medicare coverage as outlined in the insurance contract.

Understanding the Notice of Non-Coverage

A Notice of Noncoverage, or “Advance Beneficiary Notice of Noncoverage (ABN)”, informs patients about services that may not be covered by Medicare. Reasons for non-coverage may include:

- The service isn’t medically necessary

- The patient doesn’t meet the criteria for home health care services

- The service is non-skilled

Patients should receive this notice prior to the start of home health care services to avoid unexpected out-of-pocket expenses.

Steps to Take If You Believe Services Are Ending Too Soon

Your home health care agency should provide a notice a few days in advance if services are concluding. If you don’t receive this notice, request it.

This notice will detail why services are ending and how to apply for a fast appeal if you believe they are terminating prematurely.

During the fast appeal process, a Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) reviews your case to determine if your home health care services should be extended.

This organization will inquire about your reasons for wanting continued services, review your medical records, and consult with your primary physician.

Typically, the BFCC-QIO will provide a decision within three days. If you do not initiate a fast appeal before your services conclude, your home health care agency must send you a Notice of Noncoverage.

Filing Complaints About Home Health Care Services

If you have concerns regarding the quality of care from a home health agency, you should contact:

- Your state home health hotline, which your agency should provide when you begin services.

- The Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) in your state. For the contact number, visit Medicare.gov or call 1-800-MEDICARE.

Home Health Care Service Provider Checklist

This checklist can assist you and your family or friends in monitoring your home health care. Use it to ensure you receive quality care.

A Few Tips for Navigating Home Health Care Services and Medicare Coverage

If you require home health care services and are new to the process, familiarize yourself with your current medical insurance plan and its coverage.

Differentiate between Original Medicare and Medicare Advantage to understand the coverage available for your desired in-home services.

Maintain communication with your home health agency to ensure timely issuance of necessary notices, preventing unexpected out-of-pocket expenses. For more information, visit the Medicare website regarding home health care coverage.

Contact Information for Medicare Coverage Questions

If you have inquiries about your Medicare home health care benefits and you have Original Medicare, visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227).

If you receive Medicare benefits through a Medicare Advantage Plan (Part C) or another Medicare health plan, contact your plan directly. You may also reach out to the State Health Insurance Assistance Program (SHIP).

SHIP counselors can answer questions about Medicare’s home health benefits and coverage provided by Medicare, Medicaid, and other insurance types. To find your SHIP’s contact number, visit shiptacenter.org or call 1-800-MEDICARE.

Frequently Asked Questions

#1 Question: Who qualifies for home health care services?

Answer: To qualify, you must be homebound, certified by a doctor. Being homebound means you have difficulty leaving home without assistance due to an illness or injury, or it’s not advisable for you to leave due to your condition.

#2 Question: What home health services are covered by Medicare?

Answer: Medicare covers Skilled Nursing Care, Physical Therapy, Occupational Therapy, Speech-Language Pathology Services, Home Health Aide Services, Medical Social Services, and Medical Supplies.

#3 Question: What happens after a doctor refers you for home health care services?

Answer: You will choose an agency from the Medicare-certified home health agencies in your area. Your hospital discharge planner or referring agency should assist you while respecting your choices, although availability and insurance coverage may limit your options.

#4 Question: What is a Plan of Care, and does your home health care service agency provide this?

Answer: A Plan of Care outlines the services and care you should receive based on your medical condition. It includes the services required, health professionals involved, frequency of care, visiting schedule, necessary medical equipment, and expected treatment outcomes. This is typically established during your first visit with the home health care agency.

#5 Question: What is the best way to choose a Medicare-approved home care service agency?

Answer: Refer to this article on the 7 tips to finding a good Medicare Approved Home Health Care Agency.

#6 Question: How long will Medicare pay for home health care?

Answer: Medicare will cover home health care as long as you meet specific conditions, such as requiring skilled nursing or therapy services and being homebound. There is no set time limit for coverage, as it varies based on individual needs and progress. Regularly review your care plan with your healthcare provider and home health agency to ensure continued necessity and coverage.