Sonida Senior Living Pursues New Growth Avenues Following $1.8B CNL Acquisition

Less than a week ago, Sonida Senior Living (NYSE: SNDA) announced a significant merger with CNL Healthcare Properties. This deal is poised to act as an “inflection point” for new growth, as highlighted by the company’s leadership.

Sonida is engaging in a $1.8 billion deal that will expand its senior living portfolio to encompass 153 owned independent living, assisted living, and memory care communities. Over the past 18 months, Sonida has also acquired 23 assets, reinforcing its position in the market.

With these strategic moves, Sonida is reclaiming its place among the top ten largest operators in the U.S. by unit count. The merger is expected to close late in the first quarter or early in the second quarter of 2026, which will “accelerate the company’s growth profile,” according to CEO Brandon Ribar.

“Once we close and integrate the CHP portfolio, we hope to return to this pace of acquisitive growth,” Ribar stated during a recent earnings call. He emphasized that the commitment of a new upsized $300 million revolver at the close of the transaction will enhance their available capital, allowing them to capitalize on a robust investment pipeline in the latter half of 2026.

In addition to preparing for growth, Sonida has improved its weighted average occupancy rate to 87.7% in the third quarter of the year. By the end of this quarter, Sonida’s net operating income (NOI) margin reached 27.3%, a slight decline from the previous quarter’s 28.6%.

Currently, Sonida’s stock is priced at $32.20, reflecting a modest increase of 0.4% from the previous close.

Springboarding off the CNL merger

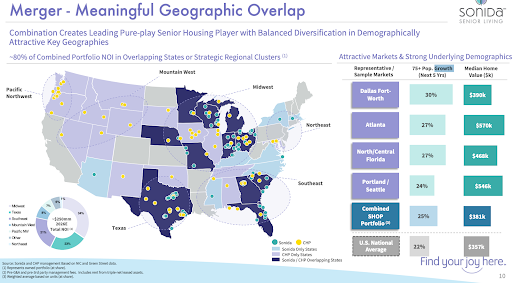

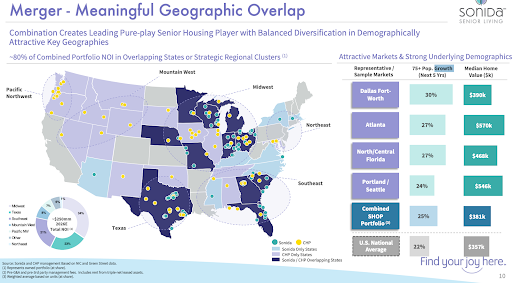

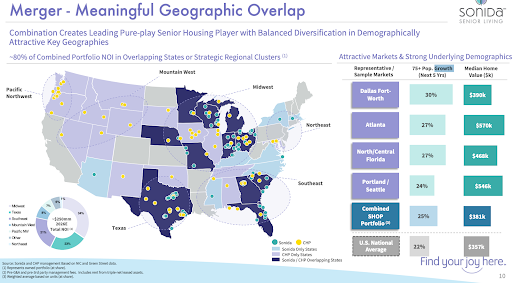

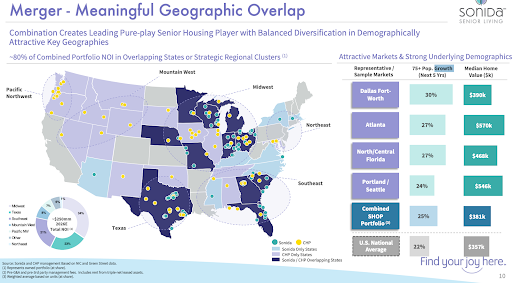

Upon closing the deal with CNL Healthcare Properties, Sonida will benefit from a more flexible balance sheet, providing them with the financial capacity to transact in “growth markets where building density likely makes sense,” according to Ribar.

Sonida has already established a presence in Texas, the Southeast, and the Midwest, and Ribar sees further opportunities across the U.S. The company is currently focusing on “disciplined inorganic accretive growth through acquisitions, joint ventures, and third-party management contracts” in the Rocky Mountain and mid-Atlantic regions, complementing CNL Healthcare Properties’ existing footprint.

Sonida Senior Living 3Q investor presentation

Sonida Senior Living 3Q investor presentationLooking ahead, Sonida aims to strengthen its position under an “owner, operator, investor” model. This approach allows the company’s regional clusters and density to enhance community management.

Leadership believes that Sonida occupies a unique market niche, blending elements of both real estate investment trusts (REITs) and operators. They are also committed to maintaining balance sheet flexibility to seize future opportunities.

Sonida’s market position provides several advantages, including the ability to leverage local and regional operating structures, enhanced market knowledge, operational synergies, and flexibility in staffing across local and regional portfolios. This also supports a wider leadership and development pool, aiding in talent retention and growth.

Growth in results

Sonida is not only expanding through acquisitions but is also achieving operational improvements within its communities.

The company has restructured its labor force, which has led to reduced turnover and increased stability in local leadership. This stability has helped manage labor costs while ensuring consistent wage growth. New scheduling systems and clearer communication have improved staff responsiveness to resident needs, according to Ribar.

“We continue to experience meaningful reductions in staff turnover on a year-over-year basis, which also supports strong care and services for our residents,” he noted.

Sonida has also significantly reduced its reliance on contract labor, which now constitutes just a small fraction of labor expenses.

As the company continues to expand, Ribar expressed confidence in attracting top talent committed to delivering high-quality care and services to residents.

One of Sonida’s primary focuses over the past year has been stabilizing the 19 communities acquired in 2024. These communities experienced a 370 basis point increase from the second quarter to the third quarter of this year, reaching an average occupancy of 83.7%.

Additionally, Sonida increased resident rates by 4.2% for these communities, according to Ribar.

This successful integration of communities into its operating platform enhances the company’s confidence in executing the “more complex and scaled transaction” through its merger with CNL Healthcare Properties.

Shifting additional resources to the marketing team has resulted in a broader and more consistent sales funnel, as noted by Kevin Detz, Sonida’s chief financial officer.

Sonida has also focused on internal sales leads, reducing reliance on third-party referrals from 43% to 26% year over year. Enhanced digital marketing efforts have led to increased lead volume and quality of referrals, according to Ribar. Sales staff have received additional training, and the operator has benefited from strong demographic trends in its “strong growth markets.”

However, occupancy trends have lagged behind industry averages by approximately 200 basis points earlier this year, with most portfolio growth occurring in the latter half of the third quarter, as noted by Ribar.

“We’ve seen a combination of reduced move-outs due to death and increased move-ins generated through our internal mechanisms, which ultimately supports overall margin and growth,” Ribar explained. “We’re pleased to be nearing 90% occupancy, but we recognize that continued growth and margin flow-through are critical areas of focus as we close out the year.”

Less than a week ago, Sonida Senior Living (NYSE: SNDA) announced a significant merger with CNL Healthcare Properties. This deal is poised to act as an “inflection point” for new growth, as highlighted by the company’s leadership.

Sonida is engaging in a $1.8 billion deal that will expand its senior living portfolio to encompass 153 owned independent living, assisted living, and memory care communities. Over the past 18 months, Sonida has also acquired 23 assets, reinforcing its position in the market.

With these strategic moves, Sonida is reclaiming its place among the top ten largest operators in the U.S. by unit count. The merger is expected to close late in the first quarter or early in the second quarter of 2026, which will “accelerate the company’s growth profile,” according to CEO Brandon Ribar.

“Once we close and integrate the CHP portfolio, we hope to return to this pace of acquisitive growth,” Ribar stated during a recent earnings call. He emphasized that the commitment of a new upsized $300 million revolver at the close of the transaction will enhance their available capital, allowing them to capitalize on a robust investment pipeline in the latter half of 2026.

In addition to preparing for growth, Sonida has improved its weighted average occupancy rate to 87.7% in the third quarter of the year. By the end of this quarter, Sonida’s net operating income (NOI) margin reached 27.3%, a slight decline from the previous quarter’s 28.6%.

Currently, Sonida’s stock is priced at $32.20, reflecting a modest increase of 0.4% from the previous close.

Springboarding off the CNL merger

Upon closing the deal with CNL Healthcare Properties, Sonida will benefit from a more flexible balance sheet, providing them with the financial capacity to transact in “growth markets where building density likely makes sense,” according to Ribar.

Sonida has already established a presence in Texas, the Southeast, and the Midwest, and Ribar sees further opportunities across the U.S. The company is currently focusing on “disciplined inorganic accretive growth through acquisitions, joint ventures, and third-party management contracts” in the Rocky Mountain and mid-Atlantic regions, complementing CNL Healthcare Properties’ existing footprint.

Sonida Senior Living 3Q investor presentation

Sonida Senior Living 3Q investor presentationLooking ahead, Sonida aims to strengthen its position under an “owner, operator, investor” model. This approach allows the company’s regional clusters and density to enhance community management.

Leadership believes that Sonida occupies a unique market niche, blending elements of both real estate investment trusts (REITs) and operators. They are also committed to maintaining balance sheet flexibility to seize future opportunities.

Sonida’s market position provides several advantages, including the ability to leverage local and regional operating structures, enhanced market knowledge, operational synergies, and flexibility in staffing across local and regional portfolios. This also supports a wider leadership and development pool, aiding in talent retention and growth.

Growth in results

Sonida is not only expanding through acquisitions but is also achieving operational improvements within its communities.

The company has restructured its labor force, which has led to reduced turnover and increased stability in local leadership. This stability has helped manage labor costs while ensuring consistent wage growth. New scheduling systems and clearer communication have improved staff responsiveness to resident needs, according to Ribar.

“We continue to experience meaningful reductions in staff turnover on a year-over-year basis, which also supports strong care and services for our residents,” he noted.

Sonida has also significantly reduced its reliance on contract labor, which now constitutes just a small fraction of labor expenses.

As the company continues to expand, Ribar expressed confidence in attracting top talent committed to delivering high-quality care and services to residents.

One of Sonida’s primary focuses over the past year has been stabilizing the 19 communities acquired in 2024. These communities experienced a 370 basis point increase from the second quarter to the third quarter of this year, reaching an average occupancy of 83.7%.

Additionally, Sonida increased resident rates by 4.2% for these communities, according to Ribar.

This successful integration of communities into its operating platform enhances the company’s confidence in executing the “more complex and scaled transaction” through its merger with CNL Healthcare Properties.

Shifting additional resources to the marketing team has resulted in a broader and more consistent sales funnel, as noted by Kevin Detz, Sonida’s chief financial officer.

Sonida has also focused on internal sales leads, reducing reliance on third-party referrals from 43% to 26% year over year. Enhanced digital marketing efforts have led to increased lead volume and quality of referrals, according to Ribar. Sales staff have received additional training, and the operator has benefited from strong demographic trends in its “strong growth markets.”

However, occupancy trends have lagged behind industry averages by approximately 200 basis points earlier this year, with most portfolio growth occurring in the latter half of the third quarter, as noted by Ribar.

“We’ve seen a combination of reduced move-outs due to death and increased move-ins generated through our internal mechanisms, which ultimately supports overall margin and growth,” Ribar explained. “We’re pleased to be nearing 90% occupancy, but we recognize that continued growth and margin flow-through are critical areas of focus as we close out the year.”