German Insurers Face $108 Billion in Illiquid Debt, EIOPA Reports

As of the end of last year, German insurers held €91.8 billion ($108 billion) in unlisted notes, which accounts for over 40% of their total bond holdings. This statistic underscores the substantial commitment of German insurers to illiquid assets.

When excluding index- or unit-linked investments, European insurers collectively held approximately €1.2 trillion in corporate bonds, with around 13% categorized as illiquid or unlisted. EIOPA cautioned that insurers could face “substantial losses” if they are forced to sell these assets below their book value during economic downturns.

This exposure is particularly concerning given that Germany has already been a focal point in the global commercial real estate crisis over the past two years, with private debt playing a significant role. Insurers in Germany have incurred billions in losses due to the collapse of several developers, including Rene Benko’s Signa conglomerate. Additionally, more pension funds have indicated potential further losses stemming from risky investments.

Illiquid or unlisted bonds, such as some debt issued by Signa, enable smaller firms to issue debt without the stringent disclosure requirements typically associated with public markets. This lack of transparency can pose risks for institutional investors, even as the standardized bond format facilitates their purchase.

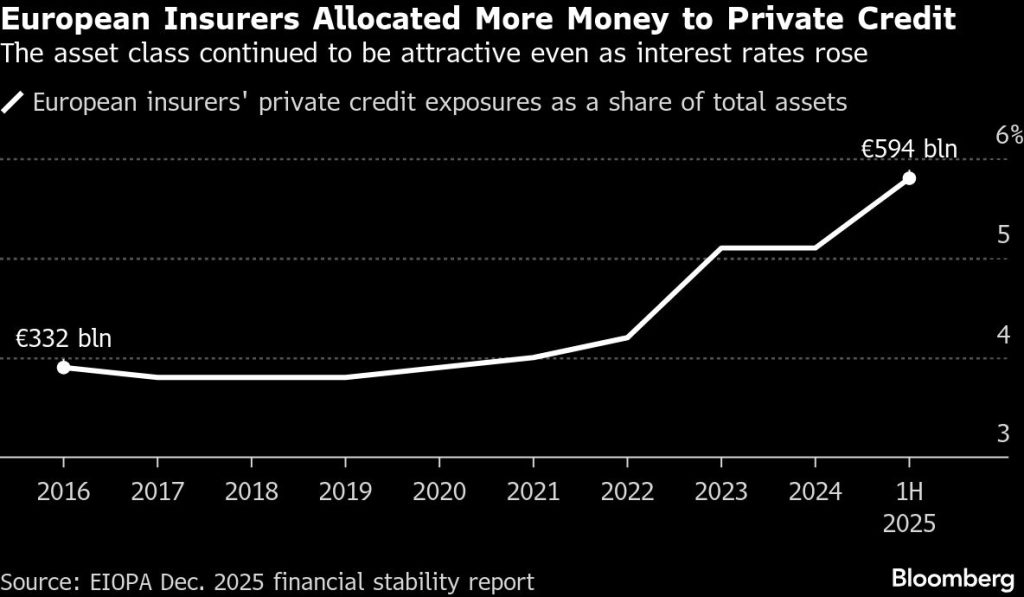

Since 2016, European insurers’ private credit holdings have surged nearly 80%, reaching €594 billion by June, now representing 5.8% of their total assets. Occupational pension funds reported an exposure of €128.4 billion, or 4.4% of their total assets, at the end of 2024, according to EIOPA.

Germany, the Netherlands, and France collectively account for 72% of insurers’ private credit exposure, with a notable focus on domestic markets. This concentration raises concerns for regulators and investors, as it could amplify losses during economic downturns.

German insurers and occupational pension funds, including Continentale Versicherungsverbund, Gothaer Group, and Signal Iduna Group, have faced challenges due to deteriorating real estate debt, particularly as Signa collapsed following sharp interest rate increases from 2022. Furthermore, Bayerische Versorgungskammer, Germany’s largest public pension group, recently warned of potential losses related to US property investments.

More Diverse

Interestingly, EIOPA found that 39% of illiquid and unlisted corporate bonds held within the European Union are from issuers based in the holder’s country, compared to just 22% for liquid bonds. While German insurers have the highest exposure to illiquid corporate bonds, this risk is distributed across a more diverse range of individual insurers compared to other regions.

Regulators worldwide are increasingly scrutinizing the emerging risks in this sector, particularly those stemming from geographical concentration. Earlier this year, the Bank for International Settlements suggested that higher capital requirements may be necessary for entities heavily exposed to such risks.

Insurers and pension funds have been at the forefront of private credit investments in Europe, driven by the pursuit of higher yields compared to safer government bonds. However, EIOPA noted that it remains “unclear” whether European insurers will continue to increase their allocations in light of elevated public bond yields and ongoing economic volatility. This potential growth may be tempered by prudent investment regulations and conservative policies within these firms.

Copyright 2025 Bloomberg.

As of the end of last year, German insurers held €91.8 billion ($108 billion) in unlisted notes, which accounts for over 40% of their total bond holdings. This statistic underscores the substantial commitment of German insurers to illiquid assets.

When excluding index- or unit-linked investments, European insurers collectively held approximately €1.2 trillion in corporate bonds, with around 13% categorized as illiquid or unlisted. EIOPA cautioned that insurers could face “substantial losses” if they are forced to sell these assets below their book value during economic downturns.

This exposure is particularly concerning given that Germany has already been a focal point in the global commercial real estate crisis over the past two years, with private debt playing a significant role. Insurers in Germany have incurred billions in losses due to the collapse of several developers, including Rene Benko’s Signa conglomerate. Additionally, more pension funds have indicated potential further losses stemming from risky investments.

Illiquid or unlisted bonds, such as some debt issued by Signa, enable smaller firms to issue debt without the stringent disclosure requirements typically associated with public markets. This lack of transparency can pose risks for institutional investors, even as the standardized bond format facilitates their purchase.

Since 2016, European insurers’ private credit holdings have surged nearly 80%, reaching €594 billion by June, now representing 5.8% of their total assets. Occupational pension funds reported an exposure of €128.4 billion, or 4.4% of their total assets, at the end of 2024, according to EIOPA.

Germany, the Netherlands, and France collectively account for 72% of insurers’ private credit exposure, with a notable focus on domestic markets. This concentration raises concerns for regulators and investors, as it could amplify losses during economic downturns.

German insurers and occupational pension funds, including Continentale Versicherungsverbund, Gothaer Group, and Signal Iduna Group, have faced challenges due to deteriorating real estate debt, particularly as Signa collapsed following sharp interest rate increases from 2022. Furthermore, Bayerische Versorgungskammer, Germany’s largest public pension group, recently warned of potential losses related to US property investments.

More Diverse

Interestingly, EIOPA found that 39% of illiquid and unlisted corporate bonds held within the European Union are from issuers based in the holder’s country, compared to just 22% for liquid bonds. While German insurers have the highest exposure to illiquid corporate bonds, this risk is distributed across a more diverse range of individual insurers compared to other regions.

Regulators worldwide are increasingly scrutinizing the emerging risks in this sector, particularly those stemming from geographical concentration. Earlier this year, the Bank for International Settlements suggested that higher capital requirements may be necessary for entities heavily exposed to such risks.

Insurers and pension funds have been at the forefront of private credit investments in Europe, driven by the pursuit of higher yields compared to safer government bonds. However, EIOPA noted that it remains “unclear” whether European insurers will continue to increase their allocations in light of elevated public bond yields and ongoing economic volatility. This potential growth may be tempered by prudent investment regulations and conservative policies within these firms.

Copyright 2025 Bloomberg.