Significant Tax Refunds Expected from One Big Beautiful Bill Act Next Year, According to Bessent

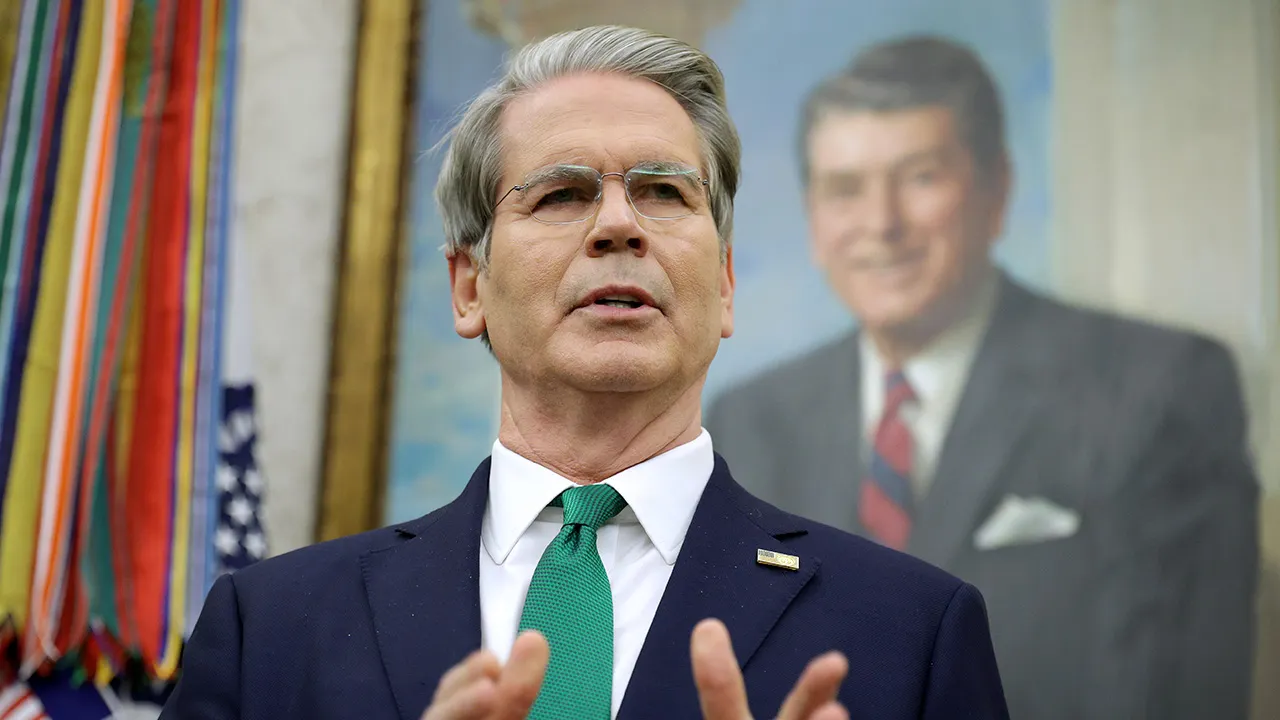

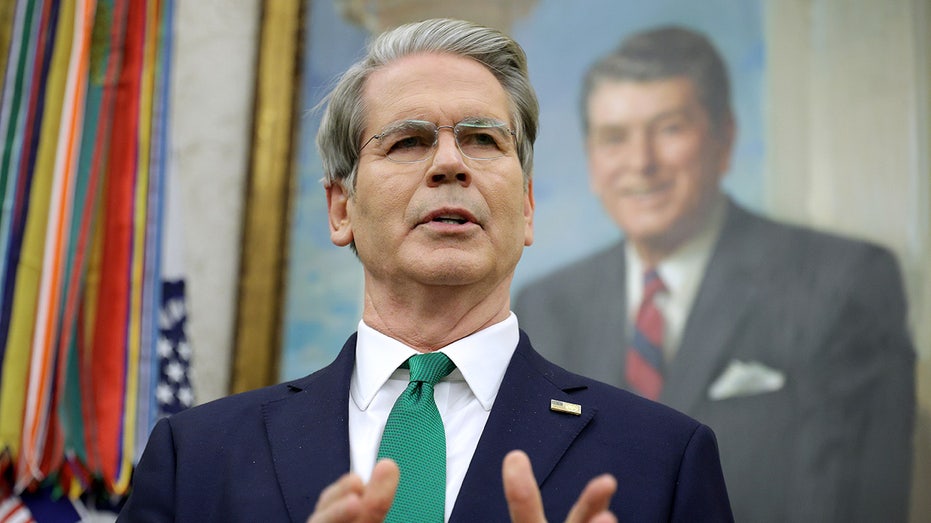

Rep. Jason Smith, R-Mo., discusses the Trump administration’s tax cuts and their impact on affordability on ’The Bottom Line.’

Treasury Secretary Scott Bessent recently announced that American households can expect “very large refunds” during the upcoming tax filing season, thanks to the policy changes introduced under the One Big Beautiful Bill Act (OBBBA).

In an interview with NBC10 Philadelphia, Bessent highlighted the potential for sizable refunds as a result of the OBBBA’s enactment. He explained that the tax law includes retroactive provisions that will affect what taxpayers owe based on this year’s earnings, potentially increasing the size of their refunds.

“The bill was passed in July. Working Americans didn’t change their withholding, so they’re going to be getting very large refunds in the first quarter,” Bessent stated. “I think we’re going to see $100 [billion]-$150 billion of refunds, which could be between $1,000 and $2,000 per household.”

IRS RELEASES GUIDANCE FOR TRUMP’S ‘NO TAX ON TIPS’ AND OVERTIME DEDUCTIONS: WHAT TO KNOW

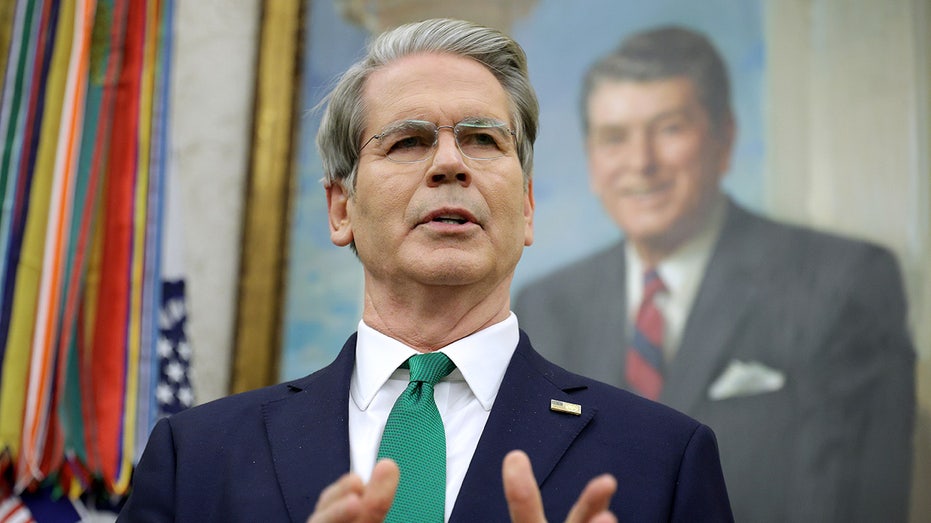

Treasury Secretary Scott Bessent said tax refunds will be substantially larger when filing season opens next year. (Alex Wong/Getty Images)

“Then they’ll change their withholding, and they’ll get a real increase in their wages. So I think 2026 can be a very good year,” Bessent added.

His remarks come amid a broader initiative by the Trump administration to highlight efforts aimed at improving affordability for Americans, with tax relief under the OBBBA being a central focus.

TRUMP PROMISES ‘LARGEST TAX REFUND SEASON EVER’ FOR AMERICANS COMING IN 2026

President Donald Trump said next year will be the “largest tax refund season ever.” (Andrew Harnik)

In addition to the new tax relief measures discussed by Bessent, the OBBBA also extends the lower tax rates and higher standard deductions that were established under the 2017 Trump tax cuts. These provisions were set to expire at the end of this year, which would have resulted in a tax increase for many taxpayers in 2026.

Earlier this month, during a Cabinet meeting, the president stated that the upcoming tax filing season is “projected to be the largest tax refund season ever.”

VOTERS EXPRESS ECONOMIC WORRIES OVER INFLATION AS COSTS RISE, FOX NEWS POLL FINDS

The IRS issued over $311 billion in tax refunds through October for the 2025 tax filing season. (Kayla Bartkowski/Getty Images)

A recent Fox News poll indicated that approximately three-fourths of respondents viewed the current economic conditions negatively, primarily due to rising costs for groceries, housing, and healthcare.

In this context, larger tax refunds could provide much-needed financial relief for households. According to IRS data from the 2025 tax filing season, over $211 billion in refunds had been issued by early April, with an average refund amount of $3,116.

The most recent figures from mid-October revealed that the total amount of refunds had increased to $311 billion, with the average refund slightly declining to $3,052. By October 17, over 102 million refunds had been processed during the 2025 filing season.

Rep. Jason Smith, R-Mo., discusses the Trump administration’s tax cuts and their impact on affordability on ’The Bottom Line.’

Treasury Secretary Scott Bessent recently announced that American households can expect “very large refunds” during the upcoming tax filing season, thanks to the policy changes introduced under the One Big Beautiful Bill Act (OBBBA).

In an interview with NBC10 Philadelphia, Bessent highlighted the potential for sizable refunds as a result of the OBBBA’s enactment. He explained that the tax law includes retroactive provisions that will affect what taxpayers owe based on this year’s earnings, potentially increasing the size of their refunds.

“The bill was passed in July. Working Americans didn’t change their withholding, so they’re going to be getting very large refunds in the first quarter,” Bessent stated. “I think we’re going to see $100 [billion]-$150 billion of refunds, which could be between $1,000 and $2,000 per household.”

IRS RELEASES GUIDANCE FOR TRUMP’S ‘NO TAX ON TIPS’ AND OVERTIME DEDUCTIONS: WHAT TO KNOW

Treasury Secretary Scott Bessent said tax refunds will be substantially larger when filing season opens next year. (Alex Wong/Getty Images)

“Then they’ll change their withholding, and they’ll get a real increase in their wages. So I think 2026 can be a very good year,” Bessent added.

His remarks come amid a broader initiative by the Trump administration to highlight efforts aimed at improving affordability for Americans, with tax relief under the OBBBA being a central focus.

TRUMP PROMISES ‘LARGEST TAX REFUND SEASON EVER’ FOR AMERICANS COMING IN 2026

President Donald Trump said next year will be the “largest tax refund season ever.” (Andrew Harnik)

In addition to the new tax relief measures discussed by Bessent, the OBBBA also extends the lower tax rates and higher standard deductions that were established under the 2017 Trump tax cuts. These provisions were set to expire at the end of this year, which would have resulted in a tax increase for many taxpayers in 2026.

Earlier this month, during a Cabinet meeting, the president stated that the upcoming tax filing season is “projected to be the largest tax refund season ever.”

VOTERS EXPRESS ECONOMIC WORRIES OVER INFLATION AS COSTS RISE, FOX NEWS POLL FINDS

The IRS issued over $311 billion in tax refunds through October for the 2025 tax filing season. (Kayla Bartkowski/Getty Images)

A recent Fox News poll indicated that approximately three-fourths of respondents viewed the current economic conditions negatively, primarily due to rising costs for groceries, housing, and healthcare.

In this context, larger tax refunds could provide much-needed financial relief for households. According to IRS data from the 2025 tax filing season, over $211 billion in refunds had been issued by early April, with an average refund amount of $3,116.

The most recent figures from mid-October revealed that the total amount of refunds had increased to $311 billion, with the average refund slightly declining to $3,052. By October 17, over 102 million refunds had been processed during the 2025 filing season.