Potential Closure of More US Beef Plants Amidst Shrinking Cattle Herds

American beef plants are facing significant challenges as the number of cattle being sent to their facilities remains alarmingly low, marking the smallest herd in over fifty years.

According to a Bloomberg survey of analysts, cattle placements in U.S. feedlots—where animals are fed until they are ready for slaughter—are expected to drop in November to the lowest levels for that month since 2015. This data, set to be released later on Friday by the U.S. Department of Agriculture, follows a record low for October, which is typically a strong month for cattle placements.

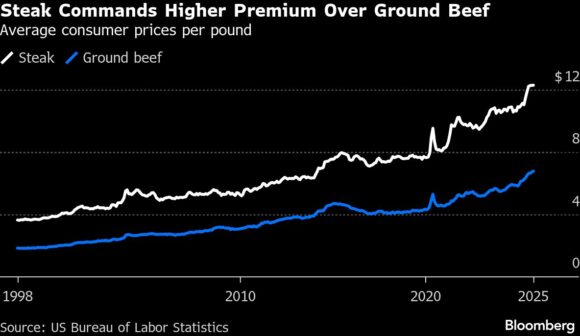

The situation is worsened by a halt in Mexican cattle shipments aimed at preventing the spread of the deadly screwworm pest. This has created significant stress for beef processors, many of whom are operating at a loss. Consequently, American steak prices are likely to remain high, complicating efforts by President Donald Trump to reduce record beef prices.

Tyson Foods Inc., the largest meatpacker in the country, highlighted the industry’s difficulties last month by announcing the closure of its Nebraska beef plant and a reduction of operations to one shift at a facility in Texas, located approximately 450 miles from the Mexican border.

Experts predict that at least one other major plant, along with several regional ones, may close within the next 18 months due to ongoing supply pressures. Hyrum Egbert, a veteran in the beef industry, noted that while the South will feel these pressures more acutely—given that many plants source live cattle from Mexico—no one is immune to the current crisis.

The Trump administration has been addressing soaring beef prices through various measures, including lifting steep tariffs on Brazilian imports. However, even with a projected 15% increase in beef imports this year to meet American demand, these imports will only account for about 17% of the nation’s supply, according to the USDA. Most of these imports consist of lean trimmings that are blended with U.S. meat for ground beef.

Many industry insiders believe that reopening the southern border is crucial for lowering steak prices, as shipments from Mexico would involve live cattle. Darin Parker, president of meat distributor PMI Foods, emphasized that opening the border would be a significant move for the administration.

Since July, livestock shipments from Mexico have been blocked due to the detection of the screwworm pest, which can kill cattle within days. The USDA has reported three cases of screwworm in Nuevo León, Mexico, since September. The agency is actively working to manage the pest on both sides of the border, with a spokesperson stating, “While we are making tremendous progress, there is still work to be done.”

The FDA has conditionally approved the first drugs to prevent and treat screwworm in cattle, including an injectable drug from Zoetis Inc. and a topical solution from Merck Animal Health.

Agriculture Secretary Brooke Rollins recently stated that the primary driver of rising beef prices is the issue of Mexican live cattle shipments and the size of the U.S. cattle herd. She expressed optimism that as the USDA continues to contain the pest, “the ports will eventually open back up” and prices will decrease.

However, some industry leaders argue that while imports are important, they are not the sole solution to high beef prices. Nate Rempe, CEO of Omaha Steaks International Inc., remarked that rebuilding the cattle herd is essential for increasing supply, a process that will take time.

In Texas, ranchers are still managing some cattle that were shipped from Mexico before the border was closed, but these numbers are rapidly declining. Laphe LaRoe, chairman of the Texas Cattle Feeders Association, estimates that supplies will be nearly exhausted by the end of the first quarter, further straining feedlot operators and meatpackers.

To cope with the limited supply, meat processors have been raising prices to secure the minimum necessary supplies for operations. Tyson’s recent plant adjustments in Texas highlight the significant impact of the supply shortfall, according to Altin Kalo, chief economist at Steiner Consulting Group.

Photo: Empty corrals at the Union Ganadera Chihuahua cattle import facility in Santa Teresa, New Mexico in June.

Copyright 2025 Bloomberg.

Topics

USA

Interested in Meat Processing?

Get automatic alerts for this topic.

American beef plants are facing significant challenges as the number of cattle being sent to their facilities remains alarmingly low, marking the smallest herd in over fifty years.

According to a Bloomberg survey of analysts, cattle placements in U.S. feedlots—where animals are fed until they are ready for slaughter—are expected to drop in November to the lowest levels for that month since 2015. This data, set to be released later on Friday by the U.S. Department of Agriculture, follows a record low for October, which is typically a strong month for cattle placements.

The situation is worsened by a halt in Mexican cattle shipments aimed at preventing the spread of the deadly screwworm pest. This has created significant stress for beef processors, many of whom are operating at a loss. Consequently, American steak prices are likely to remain high, complicating efforts by President Donald Trump to reduce record beef prices.

Tyson Foods Inc., the largest meatpacker in the country, highlighted the industry’s difficulties last month by announcing the closure of its Nebraska beef plant and a reduction of operations to one shift at a facility in Texas, located approximately 450 miles from the Mexican border.

Experts predict that at least one other major plant, along with several regional ones, may close within the next 18 months due to ongoing supply pressures. Hyrum Egbert, a veteran in the beef industry, noted that while the South will feel these pressures more acutely—given that many plants source live cattle from Mexico—no one is immune to the current crisis.

The Trump administration has been addressing soaring beef prices through various measures, including lifting steep tariffs on Brazilian imports. However, even with a projected 15% increase in beef imports this year to meet American demand, these imports will only account for about 17% of the nation’s supply, according to the USDA. Most of these imports consist of lean trimmings that are blended with U.S. meat for ground beef.

Many industry insiders believe that reopening the southern border is crucial for lowering steak prices, as shipments from Mexico would involve live cattle. Darin Parker, president of meat distributor PMI Foods, emphasized that opening the border would be a significant move for the administration.

Since July, livestock shipments from Mexico have been blocked due to the detection of the screwworm pest, which can kill cattle within days. The USDA has reported three cases of screwworm in Nuevo León, Mexico, since September. The agency is actively working to manage the pest on both sides of the border, with a spokesperson stating, “While we are making tremendous progress, there is still work to be done.”

The FDA has conditionally approved the first drugs to prevent and treat screwworm in cattle, including an injectable drug from Zoetis Inc. and a topical solution from Merck Animal Health.

Agriculture Secretary Brooke Rollins recently stated that the primary driver of rising beef prices is the issue of Mexican live cattle shipments and the size of the U.S. cattle herd. She expressed optimism that as the USDA continues to contain the pest, “the ports will eventually open back up” and prices will decrease.

However, some industry leaders argue that while imports are important, they are not the sole solution to high beef prices. Nate Rempe, CEO of Omaha Steaks International Inc., remarked that rebuilding the cattle herd is essential for increasing supply, a process that will take time.

In Texas, ranchers are still managing some cattle that were shipped from Mexico before the border was closed, but these numbers are rapidly declining. Laphe LaRoe, chairman of the Texas Cattle Feeders Association, estimates that supplies will be nearly exhausted by the end of the first quarter, further straining feedlot operators and meatpackers.

To cope with the limited supply, meat processors have been raising prices to secure the minimum necessary supplies for operations. Tyson’s recent plant adjustments in Texas highlight the significant impact of the supply shortfall, according to Altin Kalo, chief economist at Steiner Consulting Group.

Photo: Empty corrals at the Union Ganadera Chihuahua cattle import facility in Santa Teresa, New Mexico in June.

Copyright 2025 Bloomberg.

Topics

USA

Interested in Meat Processing?

Get automatic alerts for this topic.