Active ETF Managers Drive Unprecedented $1 Trillion+ Asset Surge in 2025

BlackRock U.S. head of equity ETFs Jay Jacobs explains why more investors should activate active investing and analyzes market performance as stocks slip to kick off December on ‘The Claman Countdown.’

The exchange-traded fund (ETF) industry is experiencing a remarkable year, with assets surpassing $1 trillion. A significant portion of this growth is attributed to active managers, who are reshaping the landscape of investment strategies.

According to Dan Aronson, managing director of the ETF client product specialist group at Janus Henderson, “Third-quarter activity confirmed what we’ve seen building over the past several years: Active ETFs continue to drive innovation and flows.” This trend highlights the increasing importance of active management in the ETF space.

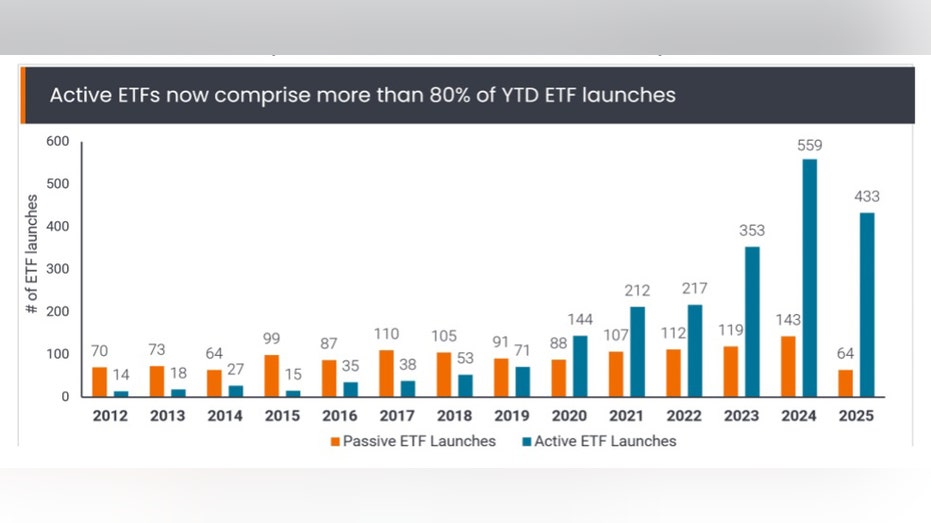

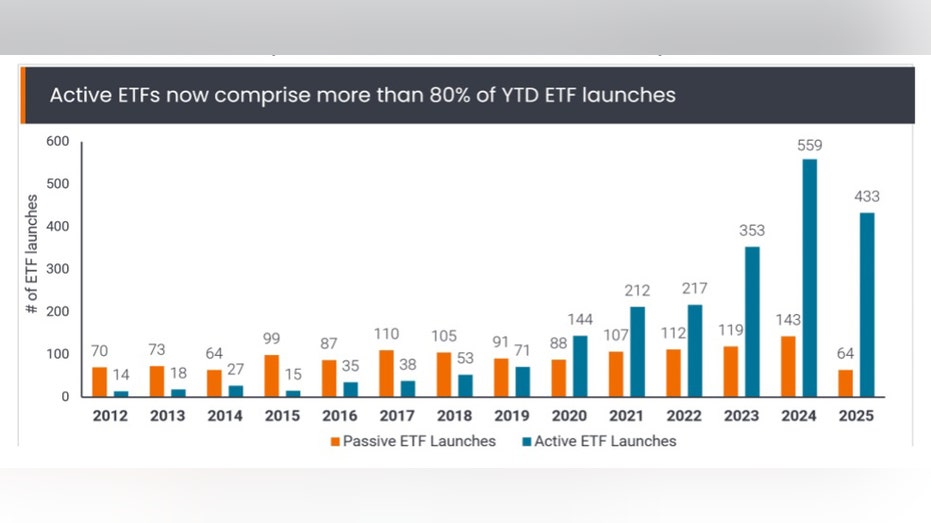

Active managers play a crucial role in selecting stocks for inclusion in ETFs, leveraging the convenience of an ETF. Notably, active ETFs account for a staggering 80% of year-to-date launches, with assets under management growing by 38%, compared to just 6% for passive ETFs. This growth is evenly distributed between fixed income and equity products.

Janus Henderson reports strong activity among active ETFs (Janus Henderson Investors)

However, it’s essential to recognize that not all funds are created equal. The average assets under management for funds aged two to three years hover around $120 million, while newer funds average only $40 million.

A snapshot of active ETF fund flows and assets under management. (Janus Henderson)

Despite the varying performance of funds, BlackRock, the world’s largest asset manager, anticipates robust ETF growth in 2026.

BILLIONAIRE JOINS MICHAEL DELL IN BACKING TRUMP SAVINGS ACCOUNTS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,065.00 | -3.14 | -0.29% |

Traders work on the floor of the New York Stock Exchange. (Michael M. Santiago/Getty Images)

Top Active ETFs: VettaFi

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JEPI | JP MORGAN ETF TRUST EQUITY PREMIUM INC ETF USD | 57.24 | -0.28 | -0.49% |

| DFAC | DIMENSIONAL ETF TRUST US CORE EQUITY 2 ETF | 39.14 | -0.29 | -0.74% |

| JPST | JPMORGAN ULTRA-SHORT INCOME ETF – USD DIS | 50.67 | -0.00 | -0.00% |

GOLDMAN SACHS TALKS SMALL CAP STOCKS

Jay Jacobs, BlackRock U.S. head of equity ETFs, shared insights with FOX Business’ Liz Claman, stating, “We’re optimistic, but people need to be nimble. I think this is where active management can provide a ton of value to navigate where we are seeing the markets up, but we are also seeing a lot more dispersion across stocks. There are some bigger winners and some bigger losers. Being able to play the stock markets the right way can really help drive investor returns in 2026.”

BlackRock U.S. head of equity ETFs Jay Jacobs explains why more investors should activate active investing and analyzes market performance as stocks slip to kick off December on ‘The Claman Countdown.’

The exchange-traded fund (ETF) industry is experiencing a remarkable year, with assets surpassing $1 trillion. A significant portion of this growth is attributed to active managers, who are reshaping the landscape of investment strategies.

According to Dan Aronson, managing director of the ETF client product specialist group at Janus Henderson, “Third-quarter activity confirmed what we’ve seen building over the past several years: Active ETFs continue to drive innovation and flows.” This trend highlights the increasing importance of active management in the ETF space.

Active managers play a crucial role in selecting stocks for inclusion in ETFs, leveraging the convenience of an ETF. Notably, active ETFs account for a staggering 80% of year-to-date launches, with assets under management growing by 38%, compared to just 6% for passive ETFs. This growth is evenly distributed between fixed income and equity products.

Janus Henderson reports strong activity among active ETFs (Janus Henderson Investors)

However, it’s essential to recognize that not all funds are created equal. The average assets under management for funds aged two to three years hover around $120 million, while newer funds average only $40 million.

A snapshot of active ETF fund flows and assets under management. (Janus Henderson)

Despite the varying performance of funds, BlackRock, the world’s largest asset manager, anticipates robust ETF growth in 2026.

BILLIONAIRE JOINS MICHAEL DELL IN BACKING TRUMP SAVINGS ACCOUNTS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,065.00 | -3.14 | -0.29% |

Traders work on the floor of the New York Stock Exchange. (Michael M. Santiago/Getty Images)

Top Active ETFs: VettaFi

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JEPI | JP MORGAN ETF TRUST EQUITY PREMIUM INC ETF USD | 57.24 | -0.28 | -0.49% |

| DFAC | DIMENSIONAL ETF TRUST US CORE EQUITY 2 ETF | 39.14 | -0.29 | -0.74% |

| JPST | JPMORGAN ULTRA-SHORT INCOME ETF – USD DIS | 50.67 | -0.00 | -0.00% |

GOLDMAN SACHS TALKS SMALL CAP STOCKS

Jay Jacobs, BlackRock U.S. head of equity ETFs, shared insights with FOX Business’ Liz Claman, stating, “We’re optimistic, but people need to be nimble. I think this is where active management can provide a ton of value to navigate where we are seeing the markets up, but we are also seeing a lot more dispersion across stocks. There are some bigger winners and some bigger losers. Being able to play the stock markets the right way can really help drive investor returns in 2026.”