Berkshire Hathaway Stock Declines Following Greg Abel’s Ascension to CEO After Warren Buffett

FOX Business host Charles Payne reflects on the legacy of Warren Buffett on his last day as CEO of Berkshire Hathaway on ‘Making Money.’

Berkshire Hathaway shares experienced a decline on Friday, following the departure of CEO Warren Buffett after an impressive 60-year tenure.

The 95-year-old officially stepped down on Thursday, with Greg Abel, who joined Berkshire in 2000 and previously served as vice chairman of its board of directors, taking over the reins on Friday.

By 3 p.m. ET on Friday, Class A shares of Berkshire Hathaway had dropped by 1.5% during afternoon trading.

In his final year as CEO, Buffett led the conglomerate to a notable gain of 10.9%, as reported by CNBC.

BUFFETT SPARKS UNITEDHEALTH’S BIGGEST WEEKLY STOCK SURGE IN 16 YEARS

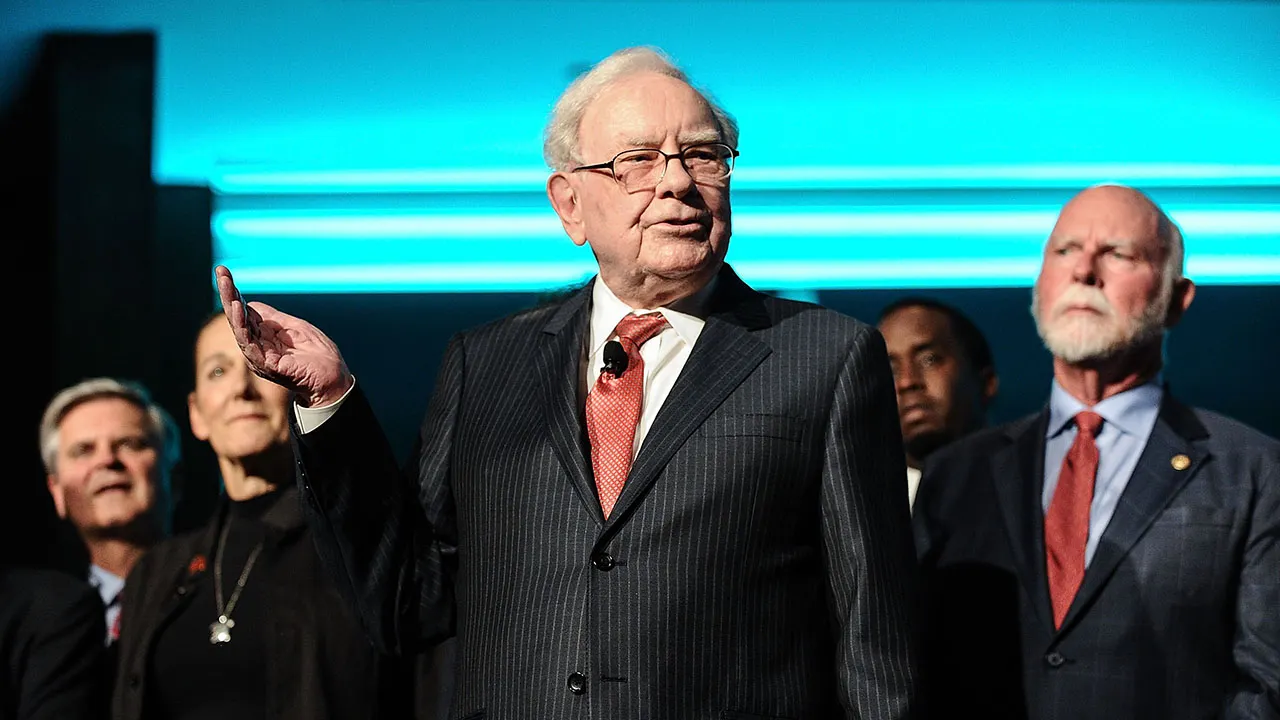

Berkshire Hathaway shares went down on Friday, a day after CEO Warren Buffett left after a 60-year run. (Daniel Zuchnik/WireImage / Getty Images)

In a heartfelt parting letter to shareholders in November, Buffett expressed, “Berkshire has less chance of a devastating disaster than any business I know. And, Berkshire has a more shareholder-conscious management and board than almost any company with which I am familiar (and I’ve seen a lot).

“Berkshire will always be managed in a manner that will make its existence an asset to the United States and eschew activities that would lead it to become a supplicant. Over time, our managers should grow quite wealthy — they have important responsibilities — but do not have the desire for dynastic or look-at-me wealth.”

On a personal note, he added, “Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government. When you help someone in any of thousands of ways, you help the world. Kindness is costless but also priceless. Whether you are religious or not, it’s hard to beat The Golden Rule as a guide to behavior.”

Buffett also took the opportunity to commend Abel, stating, “Greg Abel has more than met the high expectations I had for him when I first thought he should be Berkshire’s next CEO. He understands many of our businesses and personnel far better than I now do, and he is a very fast learner about matters many CEOs don’t even consider.”

Greg Abel officially became Berkshire Hathaway CEO Friday. (Dan Brouillette/Bloomberg via Getty Images)

WARREN BUFFETT PENS LAST LETTER AS ABEL PREPARES TO TAKE OVER

Buffett expressed his confidence in Abel, stating, “I can’t think of a CEO, a management consultant, an academic, a member of government — you name it — that I would select over Greg to handle your savings and mine.”

While Buffett has stepped down as CEO, he will continue to serve as chairman of the board.

Buffett has been grooming Abel for this leadership role for years, affirming to CNBC in 2021, “The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning.”

Shareholders attend the Berkshire Hathaway Inc annual shareholders’ meeting, in Omaha, Neb., May 3, 2025. (Reuters/Brendan McDermid)

Buffett announced his decision to step down at the end of the year during a May shareholders meeting, stating, “I think the time has arrived where Greg should become the chief executive of the company at year end.”

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Warren Buffett took the helm of Berkshire Hathaway in 1965, transforming it from a struggling textile company into a conglomerate valued at over $1 trillion. Despite his immense wealth, estimated at over $168 billion, Buffett continues to live in the modest Nebraska home he purchased for $31,500 in 1958.

FOX Business host Charles Payne reflects on the legacy of Warren Buffett on his last day as CEO of Berkshire Hathaway on ‘Making Money.’

Berkshire Hathaway shares experienced a decline on Friday, following the departure of CEO Warren Buffett after an impressive 60-year tenure.

The 95-year-old officially stepped down on Thursday, with Greg Abel, who joined Berkshire in 2000 and previously served as vice chairman of its board of directors, taking over the reins on Friday.

By 3 p.m. ET on Friday, Class A shares of Berkshire Hathaway had dropped by 1.5% during afternoon trading.

In his final year as CEO, Buffett led the conglomerate to a notable gain of 10.9%, as reported by CNBC.

BUFFETT SPARKS UNITEDHEALTH’S BIGGEST WEEKLY STOCK SURGE IN 16 YEARS

Berkshire Hathaway shares went down on Friday, a day after CEO Warren Buffett left after a 60-year run. (Daniel Zuchnik/WireImage / Getty Images)

In a heartfelt parting letter to shareholders in November, Buffett expressed, “Berkshire has less chance of a devastating disaster than any business I know. And, Berkshire has a more shareholder-conscious management and board than almost any company with which I am familiar (and I’ve seen a lot).

“Berkshire will always be managed in a manner that will make its existence an asset to the United States and eschew activities that would lead it to become a supplicant. Over time, our managers should grow quite wealthy — they have important responsibilities — but do not have the desire for dynastic or look-at-me wealth.”

On a personal note, he added, “Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government. When you help someone in any of thousands of ways, you help the world. Kindness is costless but also priceless. Whether you are religious or not, it’s hard to beat The Golden Rule as a guide to behavior.”

Buffett also took the opportunity to commend Abel, stating, “Greg Abel has more than met the high expectations I had for him when I first thought he should be Berkshire’s next CEO. He understands many of our businesses and personnel far better than I now do, and he is a very fast learner about matters many CEOs don’t even consider.”

Greg Abel officially became Berkshire Hathaway CEO Friday. (Dan Brouillette/Bloomberg via Getty Images)

WARREN BUFFETT PENS LAST LETTER AS ABEL PREPARES TO TAKE OVER

Buffett expressed his confidence in Abel, stating, “I can’t think of a CEO, a management consultant, an academic, a member of government — you name it — that I would select over Greg to handle your savings and mine.”

While Buffett has stepped down as CEO, he will continue to serve as chairman of the board.

Buffett has been grooming Abel for this leadership role for years, affirming to CNBC in 2021, “The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning.”

Shareholders attend the Berkshire Hathaway Inc annual shareholders’ meeting, in Omaha, Neb., May 3, 2025. (Reuters/Brendan McDermid)

Buffett announced his decision to step down at the end of the year during a May shareholders meeting, stating, “I think the time has arrived where Greg should become the chief executive of the company at year end.”

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Warren Buffett took the helm of Berkshire Hathaway in 1965, transforming it from a struggling textile company into a conglomerate valued at over $1 trillion. Despite his immense wealth, estimated at over $168 billion, Buffett continues to live in the modest Nebraska home he purchased for $31,500 in 1958.