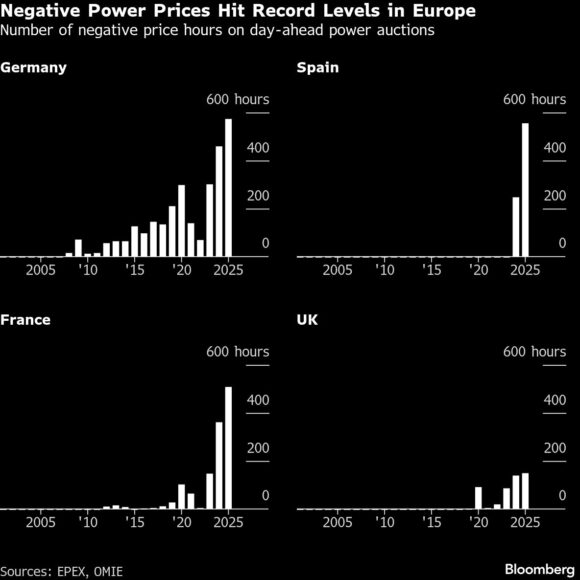

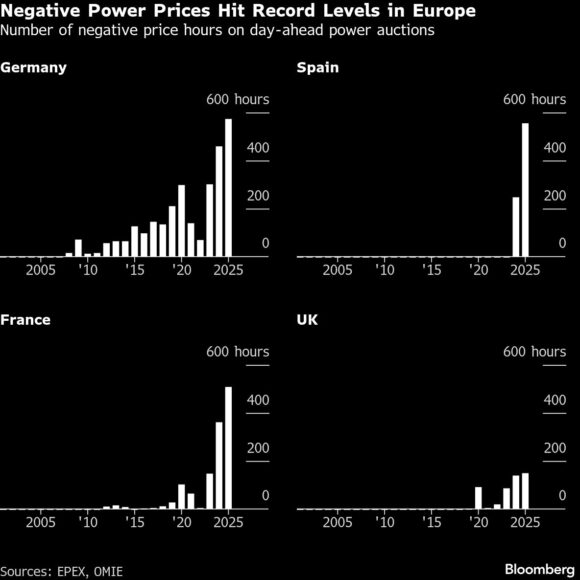

Europe Experiences Unprecedented Growth in Renewable Energy, Leading to Negative Power Prices in 2025

In 2025, Europe witnessed a remarkable surge in renewable energy output, which overwhelmed the power grid and led to electricity prices dropping below zero more frequently than ever before.

The occurrence of negative power prices highlights the clash between rapid renewable generation growth and stagnant demand, compounded by persistent grid constraints across Europe. Germany recorded an astonishing 573 hours of negative prices in 2025, marking a 25% increase from the previous year. Similarly, Spain, which first experienced negative prices in 2024, has seen this phenomenon double year-on-year.

When strong winds or abundant sunshine inundate the system with renewable energy, the demand often falls short of absorbing the surplus, driving electricity prices into negative territory. BloombergNEF forecasts that this trend will persist into 2026, as renewable capacity continues to expand at a pace that outstrips grid improvements, storage solutions, and overall consumption.

The increasing frequency of negative prices is transforming Europe’s power markets, putting pressure on revenues for renewable developers while simultaneously creating new opportunities. Trading houses are now betting on battery storage, purchasing electricity when prices dip below zero and selling it back during times of scarcity. This strategy allows them to capitalize on the widening price fluctuations driven by the weather-dependent nature of renewable energy supply.

However, grid upgrades necessary to transport electricity to where it is needed, along with battery storage solutions to retain excess power for future use, are lagging behind the rapid pace of new generation.

Despite the rapid growth of renewable energy sources, fossil fuels remain a vital component of the power system, providing backup when wind and solar output declines. During these periods, prices can experience sharp spikes. The limited transmission capacity, inadequate storage, and lack of flexible demand mean that the weather-dependent nature of renewables results in more frequent sub-zero prices during oversupply, alongside steeper price surges when supply tightens.

“These price spreads are likely to persist in 2026,” stated Florence Schmit, energy strategist at Rabobank. “The push for more renewables will be met by slowly returning power demand and an increased potential for gas and coal in some markets to meet additional load.”

Photograph: A street lamp near residential apartments in Berlin, Germany, on Thursday, Nov. 27, 2025. Photo credit: Krisztian Bocsi/Bloomberg

Copyright 2026 Bloomberg.

Topics

Europe

Personal Auto

Interested in Personal Auto?

Get automatic alerts for this topic.

In 2025, Europe witnessed a remarkable surge in renewable energy output, which overwhelmed the power grid and led to electricity prices dropping below zero more frequently than ever before.

The occurrence of negative power prices highlights the clash between rapid renewable generation growth and stagnant demand, compounded by persistent grid constraints across Europe. Germany recorded an astonishing 573 hours of negative prices in 2025, marking a 25% increase from the previous year. Similarly, Spain, which first experienced negative prices in 2024, has seen this phenomenon double year-on-year.

When strong winds or abundant sunshine inundate the system with renewable energy, the demand often falls short of absorbing the surplus, driving electricity prices into negative territory. BloombergNEF forecasts that this trend will persist into 2026, as renewable capacity continues to expand at a pace that outstrips grid improvements, storage solutions, and overall consumption.

The increasing frequency of negative prices is transforming Europe’s power markets, putting pressure on revenues for renewable developers while simultaneously creating new opportunities. Trading houses are now betting on battery storage, purchasing electricity when prices dip below zero and selling it back during times of scarcity. This strategy allows them to capitalize on the widening price fluctuations driven by the weather-dependent nature of renewable energy supply.

However, grid upgrades necessary to transport electricity to where it is needed, along with battery storage solutions to retain excess power for future use, are lagging behind the rapid pace of new generation.

Despite the rapid growth of renewable energy sources, fossil fuels remain a vital component of the power system, providing backup when wind and solar output declines. During these periods, prices can experience sharp spikes. The limited transmission capacity, inadequate storage, and lack of flexible demand mean that the weather-dependent nature of renewables results in more frequent sub-zero prices during oversupply, alongside steeper price surges when supply tightens.

“These price spreads are likely to persist in 2026,” stated Florence Schmit, energy strategist at Rabobank. “The push for more renewables will be met by slowly returning power demand and an increased potential for gas and coal in some markets to meet additional load.”

Photograph: A street lamp near residential apartments in Berlin, Germany, on Thursday, Nov. 27, 2025. Photo credit: Krisztian Bocsi/Bloomberg

Copyright 2026 Bloomberg.

Topics

Europe

Personal Auto

Interested in Personal Auto?

Get automatic alerts for this topic.