Exploring the Benefits of ‘Super Roofs’ for Insurers, Cat Bond Investors, and Homeowners

As the Trump administration stalls federal funding for projects aimed at enhancing states’ resilience to climate change, and private insurers withdraw from high-risk zones, North Carolina has demonstrated an innovative approach to disaster preparedness: a $600 million catastrophe bond that incentivizes homeowners and their insurers to install “super roofs.”

Along the picturesque beaches of North Carolina, the threat of wind damage from hurricanes has led many private insurers to cease offering coverage. Consequently, hundreds of thousands of homeowners have turned to the North Carolina Insurance Underwriting Association (NCIUA), the state’s insurer of last resort for coastal properties.

Like other insurers, NCIUA must secure its own risk mitigation strategies to ensure it can compensate customers in the event of significant damage. Options include reinsurance and catastrophe bonds, which provide payouts when damage exceeds a certain threshold. Recently, cat bonds have gained popularity among institutional investors, such as hedge funds and endowments, due to their high returns and infrequent triggers.

For years, experts have debated whether cat bonds could do more than simply address the aftermath of disasters; could they also encourage mitigation efforts that reduce initial damages? Earlier this year, NCIUA decided to explore this possibility by offering a cat bond with two features aimed at minimizing wind damage risks to homes in its portfolio.

First, if no major losses occur each year, $2 million will be returned to NCIUA, specifically designated to incentivize homeowners to install wind-resistant super roofs. Second, as more homeowners adopt these roofs, the annual pricing on the bond will adjust to reflect the changing risk exposure.

“The North Carolina program is game-changing,” said Shalini Vajjhala, founder and executive director of PRE Collective, a nonprofit based in San Diego that collaborates with communities and government agencies to overcome barriers to climate-resilient infrastructure.

The initiative traces back to 2009 when the North Carolina legislature encouraged NCIUA to explore mitigation strategies. The state was concerned as the number of homes insured by NCIUA increased, following the withdrawal of private insurers after severe storms. This situation mirrors, albeit less dramatically, the challenges faced by Florida and California, where state-sponsored insurers have taken on more properties.

After researching options to reduce liability, NCIUA identified roof fortification as a straightforward solution. This technique employs materials like ring-shank nails for better grip and enhanced sealing for the roof’s underlayer and edges.

However, a significant hurdle remained: super roofs, while effective in preventing damage, exceed building code requirements and cost approximately $3,400 more than standard roofs, deterring many homeowners from opting for them.

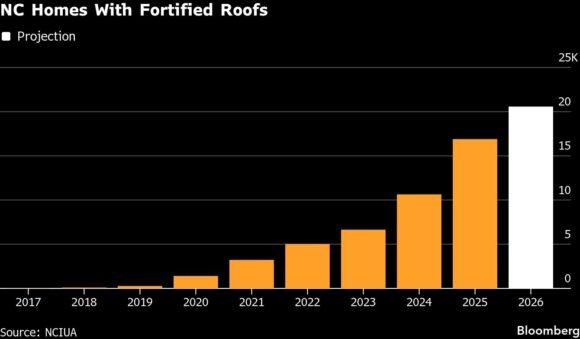

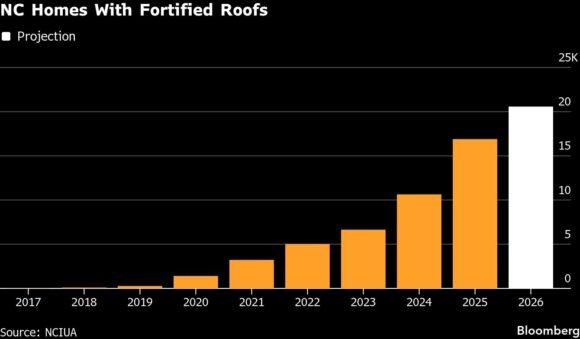

In 2017, NCIUA began offering free super-roof replacements to homeowners needing a new roof after a storm. Initially met with skepticism, the program gained traction after consumer and contractor education efforts. By 2019, NCIUA expanded its incentives, offering $6,000 grants for super roofs during routine re-roofing, later increasing this to $10,000.

Marie Raynor, 59, a lifelong resident of coastal North Carolina, was initially doubtful about the program. However, after verifying its legitimacy, she applied and received a new roof within eight weeks. “I feel like it is also a rebate for all the years I paid insurance and didn’t use it,” she remarked.

Today, over 20,574 homes have super roofs or are in the process of installation, with more than 6,000 added just this year. Financially, NCIUA has found that fortified homes have 60% fewer claims than code-compliant homes during regular storms and 20% to 30% fewer claims with lower severity during named storms.

NCIUA’s financial analysis indicates it will recoup $72 million over ten years from its investment in roofs, primarily through avoided losses after storms and reduced reinsurance costs due to a less risky portfolio.

With demand for super roofs rising, NCIUA’s CEO, Gina Hardy, sought additional funding for grants. Having previously paid for a mix of reinsurance and cat bonds, she was inspired by academic literature on cat bonds with resilience features and aimed to bring one to fruition.

“For a long time, people have been asking, ‘Could we monetize the savings from mitigation efforts to pay for the mitigation efforts?’ But it’s incredibly complex,” said Cory Anger, managing director of insurance-linked securities at Guy Carpenter, the bond’s broker. North Carolina’s successful five-year track record made the program attractive to investors.

When the Cape Lookout Re bond was launched in February, it not only secured a favorable interest rate but also attracted $600 million in investor interest, significantly exceeding expectations. “It was a really successful offering,” Anger noted.

The timing of this initiative is crucial, especially as the Trump administration has withheld billions in Building Resilient Communities and Infrastructure grants awarded by the Biden administration.

Many advocates for climate resilience are hopeful that North Carolina’s success will serve as a model for similar initiatives. “North Carolina did the really heavy lifting, and when it’s done, it opens up this whole universe of opportunities where you can basically create a plug-and-socket between programs that reduce risk and insurers who benefit,” Vajjhala explained.

While replicating this model for other climate threats may pose challenges, experts believe it’s worth exploring. Dave Jones, a professor at the University of California at Berkeley, argues that such bonds should interest all 35 state-backed insurance plans of last resort, despite varying circumstances.

Photo: A damaged roof after Hurricane Florence in Wilmington, North Carolina, in 2018. (Alex Wroblewski/Bloomberg)

Related: NC Expands Fortified Roof Program With Another $20 Million

Copyright 2025 Bloomberg.

Topics

Catastrophe

Carriers

Homeowners

As the Trump administration stalls federal funding for projects aimed at enhancing states’ resilience to climate change, and private insurers withdraw from high-risk zones, North Carolina has demonstrated an innovative approach to disaster preparedness: a $600 million catastrophe bond that incentivizes homeowners and their insurers to install “super roofs.”

Along the picturesque beaches of North Carolina, the threat of wind damage from hurricanes has led many private insurers to cease offering coverage. Consequently, hundreds of thousands of homeowners have turned to the North Carolina Insurance Underwriting Association (NCIUA), the state’s insurer of last resort for coastal properties.

Like other insurers, NCIUA must secure its own risk mitigation strategies to ensure it can compensate customers in the event of significant damage. Options include reinsurance and catastrophe bonds, which provide payouts when damage exceeds a certain threshold. Recently, cat bonds have gained popularity among institutional investors, such as hedge funds and endowments, due to their high returns and infrequent triggers.

For years, experts have debated whether cat bonds could do more than simply address the aftermath of disasters; could they also encourage mitigation efforts that reduce initial damages? Earlier this year, NCIUA decided to explore this possibility by offering a cat bond with two features aimed at minimizing wind damage risks to homes in its portfolio.

First, if no major losses occur each year, $2 million will be returned to NCIUA, specifically designated to incentivize homeowners to install wind-resistant super roofs. Second, as more homeowners adopt these roofs, the annual pricing on the bond will adjust to reflect the changing risk exposure.

“The North Carolina program is game-changing,” said Shalini Vajjhala, founder and executive director of PRE Collective, a nonprofit based in San Diego that collaborates with communities and government agencies to overcome barriers to climate-resilient infrastructure.

The initiative traces back to 2009 when the North Carolina legislature encouraged NCIUA to explore mitigation strategies. The state was concerned as the number of homes insured by NCIUA increased, following the withdrawal of private insurers after severe storms. This situation mirrors, albeit less dramatically, the challenges faced by Florida and California, where state-sponsored insurers have taken on more properties.

After researching options to reduce liability, NCIUA identified roof fortification as a straightforward solution. This technique employs materials like ring-shank nails for better grip and enhanced sealing for the roof’s underlayer and edges.

However, a significant hurdle remained: super roofs, while effective in preventing damage, exceed building code requirements and cost approximately $3,400 more than standard roofs, deterring many homeowners from opting for them.

In 2017, NCIUA began offering free super-roof replacements to homeowners needing a new roof after a storm. Initially met with skepticism, the program gained traction after consumer and contractor education efforts. By 2019, NCIUA expanded its incentives, offering $6,000 grants for super roofs during routine re-roofing, later increasing this to $10,000.

Marie Raynor, 59, a lifelong resident of coastal North Carolina, was initially doubtful about the program. However, after verifying its legitimacy, she applied and received a new roof within eight weeks. “I feel like it is also a rebate for all the years I paid insurance and didn’t use it,” she remarked.

Today, over 20,574 homes have super roofs or are in the process of installation, with more than 6,000 added just this year. Financially, NCIUA has found that fortified homes have 60% fewer claims than code-compliant homes during regular storms and 20% to 30% fewer claims with lower severity during named storms.

NCIUA’s financial analysis indicates it will recoup $72 million over ten years from its investment in roofs, primarily through avoided losses after storms and reduced reinsurance costs due to a less risky portfolio.

With demand for super roofs rising, NCIUA’s CEO, Gina Hardy, sought additional funding for grants. Having previously paid for a mix of reinsurance and cat bonds, she was inspired by academic literature on cat bonds with resilience features and aimed to bring one to fruition.

“For a long time, people have been asking, ‘Could we monetize the savings from mitigation efforts to pay for the mitigation efforts?’ But it’s incredibly complex,” said Cory Anger, managing director of insurance-linked securities at Guy Carpenter, the bond’s broker. North Carolina’s successful five-year track record made the program attractive to investors.

When the Cape Lookout Re bond was launched in February, it not only secured a favorable interest rate but also attracted $600 million in investor interest, significantly exceeding expectations. “It was a really successful offering,” Anger noted.

The timing of this initiative is crucial, especially as the Trump administration has withheld billions in Building Resilient Communities and Infrastructure grants awarded by the Biden administration.

Many advocates for climate resilience are hopeful that North Carolina’s success will serve as a model for similar initiatives. “North Carolina did the really heavy lifting, and when it’s done, it opens up this whole universe of opportunities where you can basically create a plug-and-socket between programs that reduce risk and insurers who benefit,” Vajjhala explained.

While replicating this model for other climate threats may pose challenges, experts believe it’s worth exploring. Dave Jones, a professor at the University of California at Berkeley, argues that such bonds should interest all 35 state-backed insurance plans of last resort, despite varying circumstances.

Photo: A damaged roof after Hurricane Florence in Wilmington, North Carolina, in 2018. (Alex Wroblewski/Bloomberg)

Related: NC Expands Fortified Roof Program With Another $20 Million

Copyright 2025 Bloomberg.

Topics

Catastrophe

Carriers

Homeowners