Icahn Money Manager Files Lawsuit Against Bausch + Lomb and Superiors for Alleged Anti-White Discrimination

A money manager at Carl Icahn’s investment firm is suing Bausch + Lomb Corp. and his billionaire employer, alleging he was discriminated against for being White.

The manager, Steven Miller, claims he was denied a board seat when the activist investor took a stake in the company. His suit alleges that Bausch + Lomb required one of the two board directors Icahn Capital would nominate to be “diverse,” according to a complaint filed Monday in federal court in Miami.

A fellow money manager was appointed over Miller, leading to what the suit claims is “hundreds of millions” of dollars in lost compensation. Miller is seeking at least $221 million in damages.

Miller is represented by America First Legal, a group co-founded by Stephen Miller, an adviser to former President Donald Trump. In February, AFL and Florida’s State Board of Administration filed a suit against Target Corp., alleging the retailer misled investors and customers about the risks associated with its diversity, equity, and inclusion practices.

A spokesperson for Bausch + Lomb declined to comment. Ted Papapostolou, chief financial officer at Icahn Enterprises, did not return messages seeking comment. Miller, who is not related to Stephen Miller, also did not respond to inquiries.

Icahn Capital acquired a stake in Bausch + Lomb’s parent, Bausch Health, in 2021. Miller was appointed to Bausch Health’s board alongside Brett Icahn, Carl Icahn’s son, as per the complaint. A year later, Bausch + Lomb established its own board following an initial public offering. This new board included Brett Icahn and Gaoxiang “Gary” Hu, but not Miller.

The eye-health company’s requirement for a “diverse” director was outlined in a private agreement with Icahn Capital that was not disclosed to U.S. financial regulators, according to the complaint.

Bausch + Lomb welcomed Hu’s appointment as part of its efforts to enhance shareholder value. Hu has held board positions at companies such as Dana Inc. and Occidental Petroleum Corp. and previously worked at Silver Point Capital. Both Brett Icahn and Hu left the Bausch + Lomb board earlier this year.

Hu, Brett Icahn, and Carl Icahn are also named as defendants in the suit. Hu has not responded to requests for comment, and the Icahns could not be reached.

According to the lawsuit, Miller has served on the boards of six publicly traded companies, including JetBlue Airways Corp., and has maintained a “perfect record” of shareholder votes in favor of his reelection. “But according to Bausch + Lomb’s self-imposed diversity mandate, his skin was the wrong color,” the complaint states.

The AFL alleges on behalf of Miller that the decision to exclude him from the Bausch + Lomb board violates 42 USC §1981 and Title VII of the Civil Rights Act of 1964, which prohibits race-based discrimination in contracts.

Corporate boards have become increasingly diverse over the past decade as companies emphasize diversity and inclusion. When Trump returned to the White House, he vowed to counteract explicit efforts to diversify boards, executive suites, and workplaces, particularly targeting DEI programs at companies and universities.

The complaint asserts that Miller proposed and was instrumental in Icahn Capital’s investment in Bausch + Lomb and was one of the firm’s preferred director candidates.

Before joining Icahn Capital, Miller worked as an analyst at BlueMountain Capital Management and Goldman Sachs Group Inc. He has previously served as a board director at Xerox Holdings Corp. and Herc Holdings and is currently on JetBlue’s board.

The case is Miller v. Bausch Health Companies, US District Court for the Southern District of Florida, Case No. 25-cv-25893.

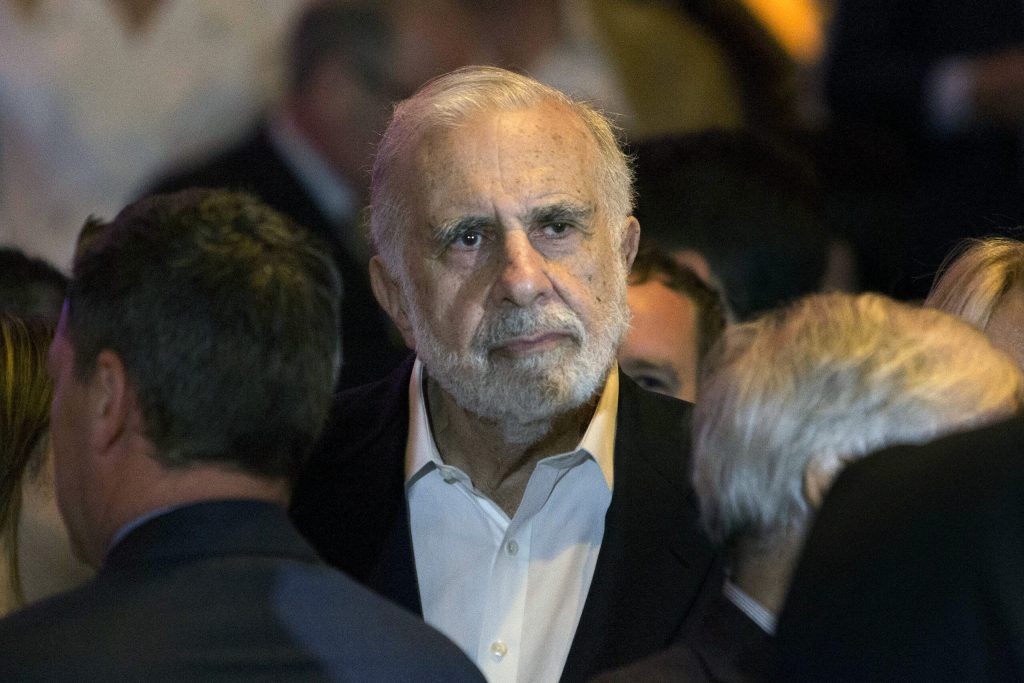

Photo: Carl Icahn at an election night event in New York in 2016. Photographer: Victor J. Blue/Bloomberg

Topics

Lawsuits

Interested in Lawsuits?

Get automatic alerts for this topic.

A money manager at Carl Icahn’s investment firm is suing Bausch + Lomb Corp. and his billionaire employer, alleging he was discriminated against for being White.

The manager, Steven Miller, claims he was denied a board seat when the activist investor took a stake in the company. His suit alleges that Bausch + Lomb required one of the two board directors Icahn Capital would nominate to be “diverse,” according to a complaint filed Monday in federal court in Miami.

A fellow money manager was appointed over Miller, leading to what the suit claims is “hundreds of millions” of dollars in lost compensation. Miller is seeking at least $221 million in damages.

Miller is represented by America First Legal, a group co-founded by Stephen Miller, an adviser to former President Donald Trump. In February, AFL and Florida’s State Board of Administration filed a suit against Target Corp., alleging the retailer misled investors and customers about the risks associated with its diversity, equity, and inclusion practices.

A spokesperson for Bausch + Lomb declined to comment. Ted Papapostolou, chief financial officer at Icahn Enterprises, did not return messages seeking comment. Miller, who is not related to Stephen Miller, also did not respond to inquiries.

Icahn Capital acquired a stake in Bausch + Lomb’s parent, Bausch Health, in 2021. Miller was appointed to Bausch Health’s board alongside Brett Icahn, Carl Icahn’s son, as per the complaint. A year later, Bausch + Lomb established its own board following an initial public offering. This new board included Brett Icahn and Gaoxiang “Gary” Hu, but not Miller.

The eye-health company’s requirement for a “diverse” director was outlined in a private agreement with Icahn Capital that was not disclosed to U.S. financial regulators, according to the complaint.

Bausch + Lomb welcomed Hu’s appointment as part of its efforts to enhance shareholder value. Hu has held board positions at companies such as Dana Inc. and Occidental Petroleum Corp. and previously worked at Silver Point Capital. Both Brett Icahn and Hu left the Bausch + Lomb board earlier this year.

Hu, Brett Icahn, and Carl Icahn are also named as defendants in the suit. Hu has not responded to requests for comment, and the Icahns could not be reached.

According to the lawsuit, Miller has served on the boards of six publicly traded companies, including JetBlue Airways Corp., and has maintained a “perfect record” of shareholder votes in favor of his reelection. “But according to Bausch + Lomb’s self-imposed diversity mandate, his skin was the wrong color,” the complaint states.

The AFL alleges on behalf of Miller that the decision to exclude him from the Bausch + Lomb board violates 42 USC §1981 and Title VII of the Civil Rights Act of 1964, which prohibits race-based discrimination in contracts.

Corporate boards have become increasingly diverse over the past decade as companies emphasize diversity and inclusion. When Trump returned to the White House, he vowed to counteract explicit efforts to diversify boards, executive suites, and workplaces, particularly targeting DEI programs at companies and universities.

The complaint asserts that Miller proposed and was instrumental in Icahn Capital’s investment in Bausch + Lomb and was one of the firm’s preferred director candidates.

Before joining Icahn Capital, Miller worked as an analyst at BlueMountain Capital Management and Goldman Sachs Group Inc. He has previously served as a board director at Xerox Holdings Corp. and Herc Holdings and is currently on JetBlue’s board.

The case is Miller v. Bausch Health Companies, US District Court for the Southern District of Florida, Case No. 25-cv-25893.

Photo: Carl Icahn at an election night event in New York in 2016. Photographer: Victor J. Blue/Bloomberg

Topics

Lawsuits

Interested in Lawsuits?

Get automatic alerts for this topic.