Senate Banking Delays Vote on Crypto CLARITY Act Amidst Opposition

Former Mayor of New York City Eric Adams joins ‘Mornings with Maria’ to discuss the launch of the New York City Coin, rising anti-Semitism, and his vision to make NYC a global crypto hub.

A committee vote on the long-awaited cryptocurrency market structure legislation was postponed on Wednesday night. This delay followed a late-night policy debate among committee members and industry leaders, which ultimately led to a withdrawal of support for the critical CLARITY Act.

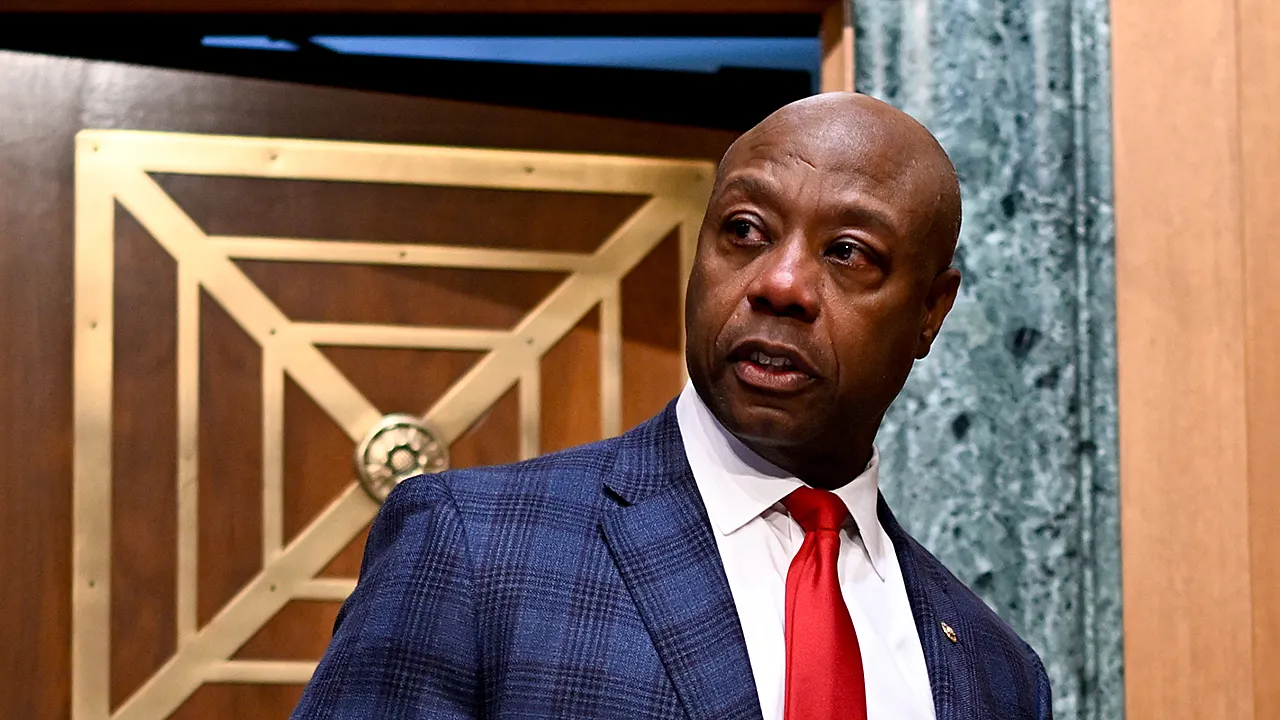

The vote to advance the bill through the Senate Banking Committee was initially scheduled for Thursday. Despite this setback, Senate Banking Chairman Tim Scott, R-S.C., remains optimistic about the bill’s future. He emphasized that the GOP has been diligently working to secure bipartisan support for the legislation.

SEN RICHARD BLUMENTHAL: CRYPTO IS A GAMBLE OUR FINANCIAL SYSTEM DOESN’T NEED

The delay came after Coinbase withdrew support over privacy and market concerns, though Senate Banking Chairman Tim Scott says the landmark crypto bill is still on track to eventually pass. (Daniel Heuer/Bloomberg via Getty Images / Getty Images)

“We’ve taken over 90 of the Democrats’ priorities, and we’ve filtered them,” Scott told Fox News Digital. “We really have come to the conclusion that [the priorities are] overall good enough to be a part of the process. So we have taken a lot of their input and some of the issues that they were concerned with, we as Republicans were concerned with as well, things like AML, all the money laundering issue being a priority for the Democrats.”

“But it’s also a priority for us because national security is so important to all of us,” Scott added. “Their priorities really met the day, and we were able to invent tougher rules around AML, KYC, knowing your customer, the BSA, things that they were really focused on.”

A key Senate vote on the CLARITY Act was postponed after late-night debate and industry pushback. (iStock / iStock)

The postponement was not solely due to bipartisanship issues. Coinbase CEO Brian Armstrong, who leads the world’s largest crypto exchange, withdrew support from the CLARITY Act “as written.” He expressed concerns that the bill would ban tokenized equities, restrict DeFi while expanding government access to financial data, and weaken the CFTC in favor of the SEC.

Armstrong also highlighted that the bill could eliminate stablecoin rewards, potentially allowing banks to shut out crypto competition. Following the vote’s delay, White House crypto czar David Sacks urged the industry to use this time to “resolve any remaining differences.”

“Passage of market structure legislation remains as close as it’s ever been,” Sacks posted on X. “Now is the time to set the rules of the road and secure the future of this industry.”

Brian Armstrong, CEO and Co-Founder of Coinbase posted to X withdrawing support for the CLARITY Act. (David Swanson / Reuters Photos)

The White House is committed to collaborating with Scott, members of the Senate Banking Committee, and industry stakeholders to expedite the passage of bipartisan crypto market structure legislation.

While the specific contents of the legislation are still under discussion, there is a general consensus among financial managers, both within and outside the crypto space, that federal intervention is essential. This intervention is not only vital for the success of crypto but also for consumer protection.

“As newer, more fringe industries grow and capital increases, you will have more need and oversight from the regulators,” Dominari Securities CEO Kyle Wool told Fox News Digital. “Not stifling regulations, but regulations to protect the ordinary investor to ensure we have a fair, honest, and efficient market for all.”

President Donald Trump has said he wants to make America the crypto capital of the world. (Getty Images/Photo illustration / Getty Images)

“This in turn also opens the crypto market to a wider audience and thus benefits it more by increasing liquidity and having greater depth,” Wool added. “BlackRock IBIT is a perfect example of this.”

Last year, regulation was passed when President Trump signed the landmark GENIUS Act into law. However, the market structure bill remains the most crucial element in establishing a regulatory framework for the crypto industry as a whole.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Senate Banking Chairman Scott expressed confidence that the CLARITY Act will become law before the midterm elections. “President Trump and I have talked seriously about the importance of 2026 being the year of affordability,” Scott stated. “When you look at market structure, the legislation itself, the one thing we can understand is that this is a generational shift in the direction of affordability.”

“We’re talking about creating more access for the average family around the country at lower price points ultimately,” Scott concluded.

Former Mayor of New York City Eric Adams joins ‘Mornings with Maria’ to discuss the launch of the New York City Coin, rising anti-Semitism, and his vision to make NYC a global crypto hub.

A committee vote on the long-awaited cryptocurrency market structure legislation was postponed on Wednesday night. This delay followed a late-night policy debate among committee members and industry leaders, which ultimately led to a withdrawal of support for the critical CLARITY Act.

The vote to advance the bill through the Senate Banking Committee was initially scheduled for Thursday. Despite this setback, Senate Banking Chairman Tim Scott, R-S.C., remains optimistic about the bill’s future. He emphasized that the GOP has been diligently working to secure bipartisan support for the legislation.

SEN RICHARD BLUMENTHAL: CRYPTO IS A GAMBLE OUR FINANCIAL SYSTEM DOESN’T NEED

The delay came after Coinbase withdrew support over privacy and market concerns, though Senate Banking Chairman Tim Scott says the landmark crypto bill is still on track to eventually pass. (Daniel Heuer/Bloomberg via Getty Images / Getty Images)

“We’ve taken over 90 of the Democrats’ priorities, and we’ve filtered them,” Scott told Fox News Digital. “We really have come to the conclusion that [the priorities are] overall good enough to be a part of the process. So we have taken a lot of their input and some of the issues that they were concerned with, we as Republicans were concerned with as well, things like AML, all the money laundering issue being a priority for the Democrats.”

“But it’s also a priority for us because national security is so important to all of us,” Scott added. “Their priorities really met the day, and we were able to invent tougher rules around AML, KYC, knowing your customer, the BSA, things that they were really focused on.”

A key Senate vote on the CLARITY Act was postponed after late-night debate and industry pushback. (iStock / iStock)

The postponement was not solely due to bipartisanship issues. Coinbase CEO Brian Armstrong, who leads the world’s largest crypto exchange, withdrew support from the CLARITY Act “as written.” He expressed concerns that the bill would ban tokenized equities, restrict DeFi while expanding government access to financial data, and weaken the CFTC in favor of the SEC.

Armstrong also highlighted that the bill could eliminate stablecoin rewards, potentially allowing banks to shut out crypto competition. Following the vote’s delay, White House crypto czar David Sacks urged the industry to use this time to “resolve any remaining differences.”

“Passage of market structure legislation remains as close as it’s ever been,” Sacks posted on X. “Now is the time to set the rules of the road and secure the future of this industry.”

Brian Armstrong, CEO and Co-Founder of Coinbase posted to X withdrawing support for the CLARITY Act. (David Swanson / Reuters Photos)

The White House is committed to collaborating with Scott, members of the Senate Banking Committee, and industry stakeholders to expedite the passage of bipartisan crypto market structure legislation.

While the specific contents of the legislation are still under discussion, there is a general consensus among financial managers, both within and outside the crypto space, that federal intervention is essential. This intervention is not only vital for the success of crypto but also for consumer protection.

“As newer, more fringe industries grow and capital increases, you will have more need and oversight from the regulators,” Dominari Securities CEO Kyle Wool told Fox News Digital. “Not stifling regulations, but regulations to protect the ordinary investor to ensure we have a fair, honest, and efficient market for all.”

President Donald Trump has said he wants to make America the crypto capital of the world. (Getty Images/Photo illustration / Getty Images)

“This in turn also opens the crypto market to a wider audience and thus benefits it more by increasing liquidity and having greater depth,” Wool added. “BlackRock IBIT is a perfect example of this.”

Last year, regulation was passed when President Trump signed the landmark GENIUS Act into law. However, the market structure bill remains the most crucial element in establishing a regulatory framework for the crypto industry as a whole.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Senate Banking Chairman Scott expressed confidence that the CLARITY Act will become law before the midterm elections. “President Trump and I have talked seriously about the importance of 2026 being the year of affordability,” Scott stated. “When you look at market structure, the legislation itself, the one thing we can understand is that this is a generational shift in the direction of affordability.”

“We’re talking about creating more access for the average family around the country at lower price points ultimately,” Scott concluded.