Top Insurance Trends for 2026: Cyber Insurance, Climate Change, and AI Insights from GlobalData

Artificial intelligence (AI), cyber insurance, and climate change/natural catastrophes are poised to significantly influence the insurance market by 2026, as highlighted in an annual forecast from GlobalData, a London-based data and analytics firm.

“Insurers that position themselves as leaders in these areas will experience enhanced performance, superior products, and improved customer service. Currently, AI stands out as the leading technological trend within the insurance sector,” stated Ben Carey-Evans, senior insurance analyst at GlobalData.

“The rise of agentic AI throughout 2025 has amplified interest in the technology and its potential. Its effects are felt across the entire value chain, and agentic AI’s capability to respond to real-time information and make human-like decisions will further accelerate AI’s impact on insurance in 2026 and beyond,” Carey-Evans added.

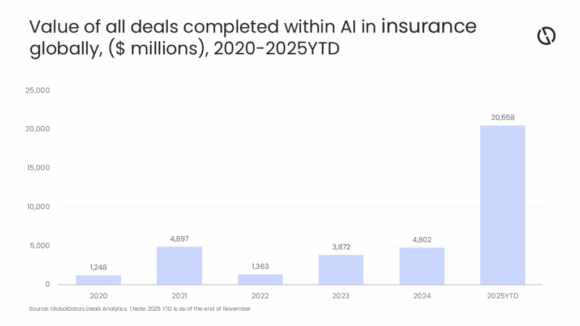

The total value of mergers and acquisitions (M&A) in the AI insurance sector surged in 2025, with a remarkable growth of 328% in value and 125% in volume. This trend, partly driven by the emergence of generative AI—particularly agentic AI—was also evident in GlobalData’s other databases.

GlobalData’s job and company filings databases indicate robust growth in AI within the insurance industry, signaling it as a key focus area for insurers. A notable example is Munich Re’s acquisition of Next Insurance in July 2025, a tech-centric commercial property and casualty insurer emphasizing AI and digitalization.

Cyber Insurance and Climate Change

The cyber insurance market is experiencing rapid growth, projected to continue through 2030. GlobalData estimates the global cyber insurance market will reach $22.2 billion in 2025 and grow to $35.4 billion by 2030.

Climate change, alongside the increasing frequency of severe weather events, poses significant challenges for insurers. The implications of these factors are expected to escalate in the coming years.

“Natural fire and hazard insurance is a critical product worldwide, with premiums and claims witnessing sharp annual increases, a trend expected to persist,” Carey-Evans noted. “The rising frequency of severe weather events presents a substantial threat to the industry, with vast regions becoming uninsurable, creating a significant dilemma for consumers.”

Related:

Topics

InsurTech

Cyber

Data Driven

Artificial Intelligence

Climate Change

Interested in AI?

Get automatic alerts for this topic.

Artificial intelligence (AI), cyber insurance, and climate change/natural catastrophes are poised to significantly influence the insurance market by 2026, as highlighted in an annual forecast from GlobalData, a London-based data and analytics firm.

“Insurers that position themselves as leaders in these areas will experience enhanced performance, superior products, and improved customer service. Currently, AI stands out as the leading technological trend within the insurance sector,” stated Ben Carey-Evans, senior insurance analyst at GlobalData.

“The rise of agentic AI throughout 2025 has amplified interest in the technology and its potential. Its effects are felt across the entire value chain, and agentic AI’s capability to respond to real-time information and make human-like decisions will further accelerate AI’s impact on insurance in 2026 and beyond,” Carey-Evans added.

The total value of mergers and acquisitions (M&A) in the AI insurance sector surged in 2025, with a remarkable growth of 328% in value and 125% in volume. This trend, partly driven by the emergence of generative AI—particularly agentic AI—was also evident in GlobalData’s other databases.

GlobalData’s job and company filings databases indicate robust growth in AI within the insurance industry, signaling it as a key focus area for insurers. A notable example is Munich Re’s acquisition of Next Insurance in July 2025, a tech-centric commercial property and casualty insurer emphasizing AI and digitalization.

Cyber Insurance and Climate Change

The cyber insurance market is experiencing rapid growth, projected to continue through 2030. GlobalData estimates the global cyber insurance market will reach $22.2 billion in 2025 and grow to $35.4 billion by 2030.

Climate change, alongside the increasing frequency of severe weather events, poses significant challenges for insurers. The implications of these factors are expected to escalate in the coming years.

“Natural fire and hazard insurance is a critical product worldwide, with premiums and claims witnessing sharp annual increases, a trend expected to persist,” Carey-Evans noted. “The rising frequency of severe weather events presents a substantial threat to the industry, with vast regions becoming uninsurable, creating a significant dilemma for consumers.”

Related:

Topics

InsurTech

Cyber

Data Driven

Artificial Intelligence

Climate Change

Interested in AI?

Get automatic alerts for this topic.