Underwriters and Actuaries Alleviate AI Concerns; Emphasis on Collaborative Efforts Required

In the evolving landscape of insurance, the integration of artificial intelligence (AI) has sparked a range of reactions among commercial P/C underwriters and actuaries. Surprisingly, many professionals in the field are neither overly concerned about AI’s potential to replace them nor dismissive of its impact.

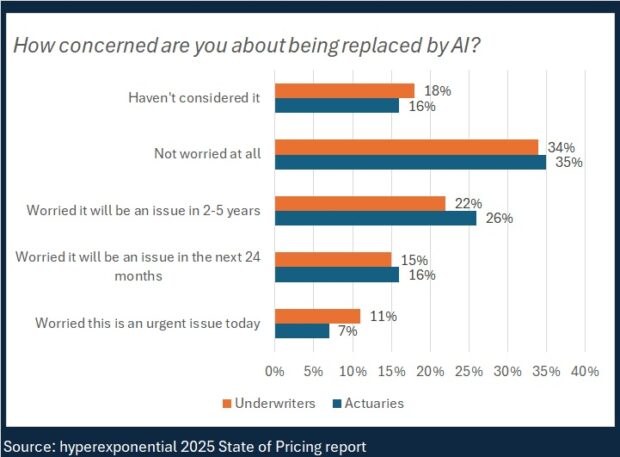

According to a recent report from hyperexponential, an AI-driven pricing and underwriting platform, a survey conducted in September revealed that 51 percent of actuaries and 52 percent of underwriters are not worried about being replaced by AI. This survey included responses from 350 U.S. and UK professionals and was carried out by Coleman Parkes.

Notably, the report highlights a significant shift in attitudes compared to a similar survey conducted in 2024. The percentage of underwriters and actuaries fearing replacement by AI has dropped dramatically—from 74 percent and 80 percent, respectively, to 48 percent and 49 percent this year. This change suggests a growing understanding and acceptance of how technology is reshaping the roles of insurance professionals.

Interestingly, over one-third of respondents acknowledged considering the possibility of being replaced by AI but expressed no real concern about it. The report also delves into the concept of “FOBO”—fear of becoming obsolete—and reveals trends in technology investments and collaboration between actuaries and underwriters.

Collaboration between these two groups has long been a goal, and the report indicates that progress is being made. Underwriters now rank pricing actuaries second in terms of effective collaboration, a notable improvement from the previous year when they were ranked last. However, actuaries still find collaboration with underwriters challenging, with only 9 percent rating it as “very effective.”

Charts in the report reveal that underwriters rated their collaboration with pricing actuaries at an average of 3.5 out of 5, while actuaries rated it lower at 3.1. Barriers to effective collaboration were also highlighted, with 38 percent of actuaries citing a lack of underwriter buy-in as a significant obstacle, while 45 percent of underwriters pointed to inaccuracies in pricing models.

Investments Grow

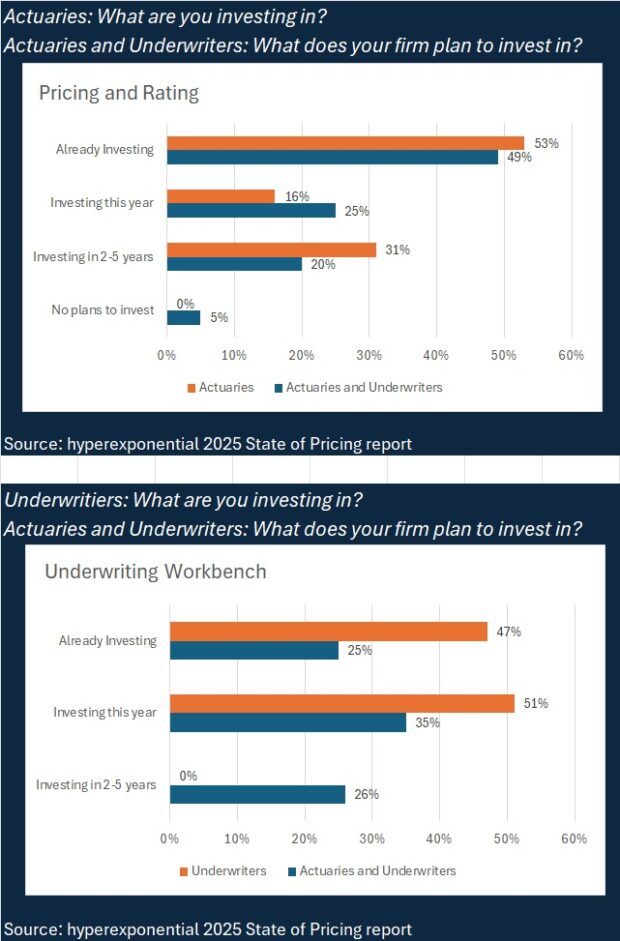

The report emphasizes the increasing focus on technology investments within the insurance sector. Nearly all surveyed insurers identified pricing and underwriting as top priorities for technology investment. Amrit Santhirasenan, CEO and co-founder of hyperexponential, noted that these functions are critical for intelligent decision-making.

According to the survey, 100 percent of actuaries plan to invest in pricing and rating technology within the next five years, while 98 percent of underwriters are looking to invest in underwriting workbench solutions within the next year. Across both groups, 94 percent indicated their organizations are investing in pricing and rating tools, and 95 percent are focusing on data and analytics.

While only 31 percent reported current investments in AI, another 36 percent plan to invest this year. Overall, two-thirds of respondents expect AI investments to occur within the next 12 months, with 89 percent anticipating them within five years.

Despite the enthusiasm for technology, 99 percent of respondents expressed challenges in effectively utilizing these tools, with many indicating a need for improvements ranging from minor adjustments to complete overhauls.

As the report states, “Actuaries and underwriters have seen what’s possible when data science, automation, and AI meet real-world pricing. The bar has been raised, and Excel simply can’t clear it anymore.”

Concerns Shift to Skills Gap

While fears of obsolescence are fading, the report indicates that underwriters and actuaries are increasingly concerned about their ability to leverage AI effectively. Many professionals feel they lack the necessary skills for the future, with nearly three-quarters of underwriters expressing a need for stronger data analysis and reporting skills.

Burnout is also a growing concern, with 73 percent of underwriters and 74 percent of actuaries reporting it as an issue. Underwriters spend significant time on manual tasks, while actuaries believe that faster, more accurate pricing models could transform their roles.

In a related survey by Accenture, over one-third of underwriting executives reported spending too much time on non-core activities. While there has been some improvement, the need for upskilling remains critical as AI becomes more integrated into the industry.

Both the hyperexponential and Accenture reports highlight a common theme: the need for expertise in data analysis and reporting is paramount for the future of both actuaries and underwriters, signaling a shift away from traditional skills.

Topics

InsurTech

Data Driven

Artificial Intelligence

Underwriting

In the evolving landscape of insurance, the integration of artificial intelligence (AI) has sparked a range of reactions among commercial P/C underwriters and actuaries. Surprisingly, many professionals in the field are neither overly concerned about AI’s potential to replace them nor dismissive of its impact.

According to a recent report from hyperexponential, an AI-driven pricing and underwriting platform, a survey conducted in September revealed that 51 percent of actuaries and 52 percent of underwriters are not worried about being replaced by AI. This survey included responses from 350 U.S. and UK professionals and was carried out by Coleman Parkes.

Notably, the report highlights a significant shift in attitudes compared to a similar survey conducted in 2024. The percentage of underwriters and actuaries fearing replacement by AI has dropped dramatically—from 74 percent and 80 percent, respectively, to 48 percent and 49 percent this year. This change suggests a growing understanding and acceptance of how technology is reshaping the roles of insurance professionals.

Interestingly, over one-third of respondents acknowledged considering the possibility of being replaced by AI but expressed no real concern about it. The report also delves into the concept of “FOBO”—fear of becoming obsolete—and reveals trends in technology investments and collaboration between actuaries and underwriters.

Collaboration between these two groups has long been a goal, and the report indicates that progress is being made. Underwriters now rank pricing actuaries second in terms of effective collaboration, a notable improvement from the previous year when they were ranked last. However, actuaries still find collaboration with underwriters challenging, with only 9 percent rating it as “very effective.”

Charts in the report reveal that underwriters rated their collaboration with pricing actuaries at an average of 3.5 out of 5, while actuaries rated it lower at 3.1. Barriers to effective collaboration were also highlighted, with 38 percent of actuaries citing a lack of underwriter buy-in as a significant obstacle, while 45 percent of underwriters pointed to inaccuracies in pricing models.

Investments Grow

The report emphasizes the increasing focus on technology investments within the insurance sector. Nearly all surveyed insurers identified pricing and underwriting as top priorities for technology investment. Amrit Santhirasenan, CEO and co-founder of hyperexponential, noted that these functions are critical for intelligent decision-making.

According to the survey, 100 percent of actuaries plan to invest in pricing and rating technology within the next five years, while 98 percent of underwriters are looking to invest in underwriting workbench solutions within the next year. Across both groups, 94 percent indicated their organizations are investing in pricing and rating tools, and 95 percent are focusing on data and analytics.

While only 31 percent reported current investments in AI, another 36 percent plan to invest this year. Overall, two-thirds of respondents expect AI investments to occur within the next 12 months, with 89 percent anticipating them within five years.

Despite the enthusiasm for technology, 99 percent of respondents expressed challenges in effectively utilizing these tools, with many indicating a need for improvements ranging from minor adjustments to complete overhauls.

As the report states, “Actuaries and underwriters have seen what’s possible when data science, automation, and AI meet real-world pricing. The bar has been raised, and Excel simply can’t clear it anymore.”

Concerns Shift to Skills Gap

While fears of obsolescence are fading, the report indicates that underwriters and actuaries are increasingly concerned about their ability to leverage AI effectively. Many professionals feel they lack the necessary skills for the future, with nearly three-quarters of underwriters expressing a need for stronger data analysis and reporting skills.

Burnout is also a growing concern, with 73 percent of underwriters and 74 percent of actuaries reporting it as an issue. Underwriters spend significant time on manual tasks, while actuaries believe that faster, more accurate pricing models could transform their roles.

In a related survey by Accenture, over one-third of underwriting executives reported spending too much time on non-core activities. While there has been some improvement, the need for upskilling remains critical as AI becomes more integrated into the industry.

Both the hyperexponential and Accenture reports highlight a common theme: the need for expertise in data analysis and reporting is paramount for the future of both actuaries and underwriters, signaling a shift away from traditional skills.

Topics

InsurTech

Data Driven

Artificial Intelligence

Underwriting